What Is The Meaning Of Gl Account

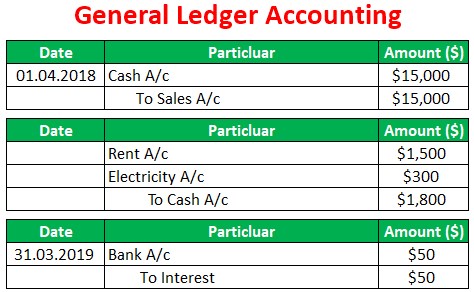

27032019 Below are some common GL Coding practices and tips to keep your Accounts Payables and Receivables from losing their minds in the complexities of accounting. GL contains all debit and credit entries of transactions and entry for the same is done.

General Ledger Vs Trial Balance Top 4 Differences With Infographics

Chart of Accounts Data TCode FSPOand.

What is the meaning of gl account. Each account is a unique record summarizing each type of asset liability equity revenue and expense. General Ledger refers to a record containing individual accounts showcasing the transactions related to each of such accounts. 25102018 Companies often use general ledger GL codes to classify accounting data in several different ways.

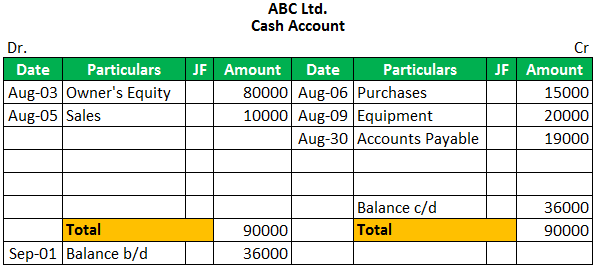

Examples of General Ledger Accounts. 05062017 An SAP general ledger account is an account that is updated each time a user posts a financial transaction in SAP system. 11092019 A general ledger account GL account is a primary component of a general ledger.

A general ledger account is an account or record used to sort store and summarize a companys transactions. General ledger for rent expense account. General Ledger Account Definitions.

These codes allow the company to sort transaction data so that it can produce several different accounting reports and provides the ability to analyze the companys accounting transactions in a variety of useful ways. You can quickly select which topic you are interested in by selecting it from the list or you can scroll down the page to view the entire table of contents. General ledger for laptop inventory account.

These accounts are used to come up with financial statements for internal and external reporting. General ledger for bank account. If you enter a valid account segment combination General Ledger automatically displays the account Type of the natural account segment value.

It is basically the comparison of 2 different documentations or reports. General ledger for cost of goods sold. Company Code Data TCode FSSO GL account master records are divided into two areas to that company code with the same chart of account can use the same GL account.

The general ledger or ledger is a record of all the accounts that the company uses. Current non-current and contingent liabilities. It is a group or collection of accounts that give you information regarding the detailed transactions with respect to each of such accounts.

A list of the GL account definition categories are available in the list below. General ledger for accounts receivable. Posting FI Posting Business Transactions in General Ledger Accounting.

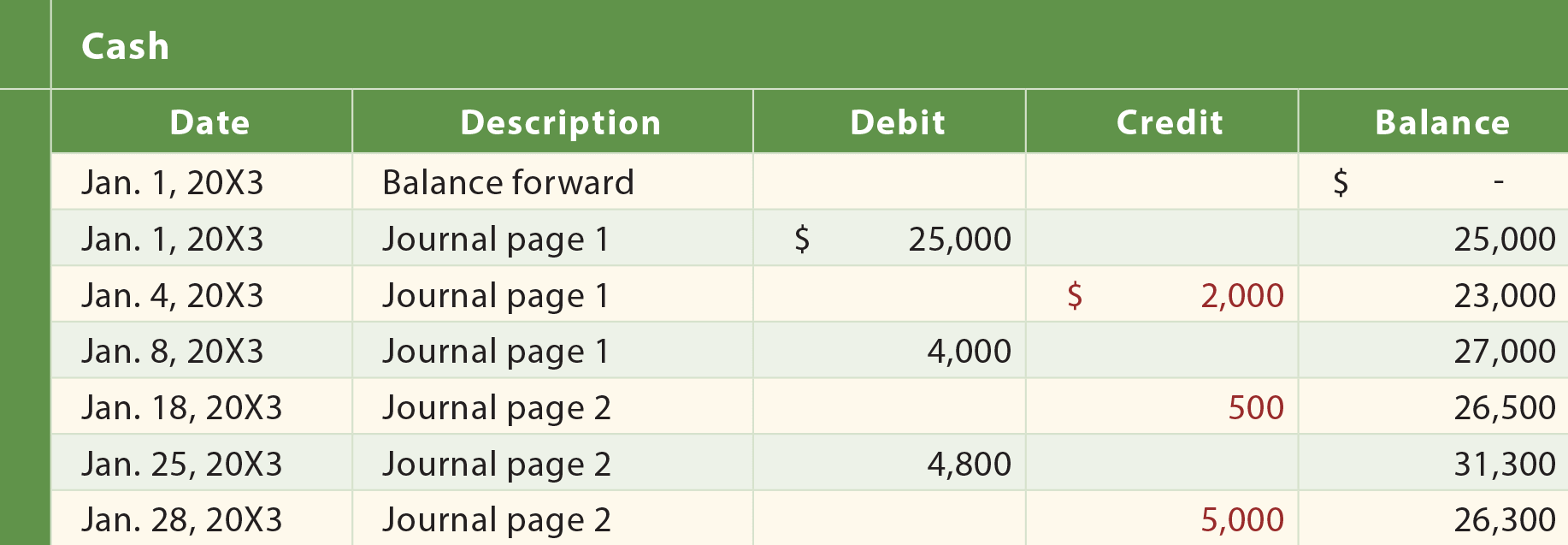

General ledger for service account. What Does General Ledger Mean. A GL account records all transactions for that account.

General Ledger GL accounts are used to provide a picture of external accounting and accounts and to record all the business transactions in a SAP system. GL Balance Sheet Reconciliation Reconciliation is generally performed in accounting for minimizing errors. The chart of account area contains the data valid for all company codes such as Account Number.

In SAP a general ledger account is identified with a number having from 1 to 10 digits. Because the GL or general ledger is made up of bank accounts so GL balance sheet reconciliation means to reconcile various accounts like cash and accounts payable. The GL is a set of master accounts and transactions are recorded and SL is an intermediary set of accounts linked to the general ledger.

Company codeplant and storage location are organization units in an enterprisecompany in the SAP system. General ledger for sales account. These accounts are arranged in the general ledger and in the chart of accounts with the balance sheet accounts appearing first followed by the income statement accounts.

General Ledger checks the account against your security and cross-validation rules. The general ledger holds financial and non-financial data for an organization. A ledger account is created for each account in the chart of accounts for an organization are classified into account categories such as income expense assets liabilities and equity and the collection of all these accounts is known as the general ledger.

A general ledger GL is a set of numbered accounts a business uses to keep track of its financial transactions and to prepare financial reports. This software system is fully integrated with all the other operational areas of a company and ensures that the accounting data is always complete and accurate. In all modern accounting systems the general ledger is computerized.

GL Coding Helps Big Data One of the great benefits to using a uniform GL Coding system is the extremely quick data analysis and reporting. 03062011 GL account is a master data where value are stored the value may be inventory cost or may be cost incurred for particular expenses. GL Account Master Data.

The transactions are related to various accounting elements including assets liabilities Types of Liabilities There are three primary types of liabilities. General ledger for accounts payable. A general ledger divides accounts into three account types.

General Ledger Accounting FI-GL Cost of Sales Accounting. There is no such direct assignment of GL Account to organization units. Account Balances and Line Items.

What Is a GL Code. 04052021 How a General Ledger Works A general ledger is the foundation of a system employed by accountants to store and organize financial data used to create the firms financial statements. All companies have a specific set of accounts that.

Assets liabilities and equity accounts.

General Ledger Accounting Meaning Types Examples How It Work

Document Splitting In New General Ledger Sap Blogs

General Ledger G L Account Balance Display Sap Tutorial

Gl Account Write Up In S 4 Hana Sap Blogs

The General Ledger Principlesofaccounting Com

Sap Fi G L Account Tutorialspoint

Sap Fi G L Account Tutorialspoint

Control Accounts Double Entry Bookkeeping