What Is The Meaning Of Ad Valorem Taxation

28062021 Definition of ad valorem. 20122017 An ad valorem tax imposes a tax on a good or asset depending on its value.

Ad Valorem Tax Meaning Examples Top 3 Types

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property.

What is the meaning of ad valorem taxation. Ad valorem taxes can however be imposed upon Personal Property. An ad valorem tax is a form of taxation based on the value of a transaction or a property either real estate or personal property. 04112020 An ad valorem tax is a property tax levied based on the value of the property in question.

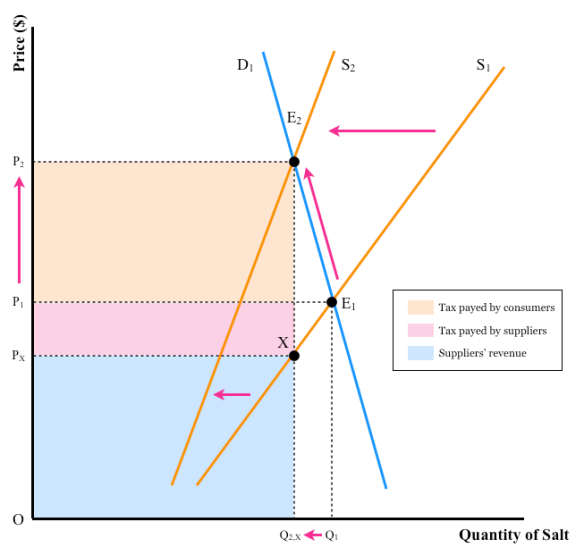

Latin expression that means according to the value. Ad valorem tax any tax imposed on the basis of the monetary value of the taxed item. This means that a firms supply curve will shift up vertically by the amount of the tax.

24042017 Ad valorem taxes are back in the spotlight because of discussion of the proposed border adjustment tax. The term ad valorem is derived from the Latin ad valentiam meaning to the value. 02042020 A unit tax is a set amount of tax per unit sold such as a 10p tax on packets of cigarettes.

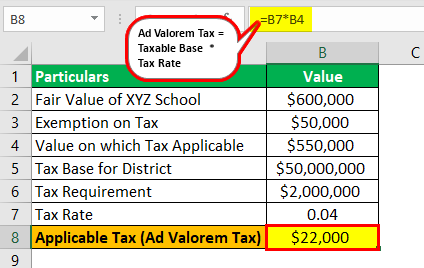

How does Ad Valorem Tax work. Real property taxes that are imposed by the states counties and cities are the most common type of ad valorem taxes. The most common ad valorem tax examples include property taxes on real estate sales tax on consumer goods and VAT on the value added to a final product or service.

This tax would be imposed on the value of goods coming into the country and goods that were. For example a motor vehicle tax may be imposed. Ad valorem taxes are taxes determined by the assessed value of an item.

It is commonly applied to a tax imposed on the value of property. It is commonly applied to a tax imposed on the value of property. For example in the UK VAT is charged at 20 on most goods offered for sale.

An ad valorem tax Latin for according to value is a tax whose amount is based on the value of a transaction or of property. Ad valorem Latin for according to the value taxes are levied solely as a percentage of a propertys market value without regard to quantity or intrinsic value. Imposed at a rate percent of value ad valorem tax on goods compare specific entry 1 sense 5b.

One prime example is the Value Added Tax VAT which varies in percentage depending on the assessed value of the goods sold. 10062020 Ad valorem taxes are common with real estate as local taxing authorities such as county and municipal governments as well as the school districts levy an annual tax based on the assessed value of the real estate in their jurisdiction. It is typically imposed at the time of a transaction as in the case of a sales tax or value-added tax VAT.

The tax base was defined in terms of physical units such as gallons pounds or individual items. The tax is usually expressed as a percentage. The term ad valorem is derived from the Latin ad valentiam meaning to the value.

Import duties or taxes expressed as a percentage of value. Its acronym is AV. Ad valorem taxes can however be imposed upon Personal Property.

The most common ad valorem taxes are. Literally the term means according to value Traditionally most customs and excises had specific rates. It is generally calculated as a percentage of the value of the.

Ad valorem means according to value. Other kind of taxes could be based on a measure of weight or size or simply units. Examples of values that could be used to determine an ad valorem tax include the price of a product for a sales tax or the assessed value of a home for a property tax.

Real property taxes that are imposed by the states counties and cities are the most common type of ad valorem taxes. What is the meaning of ad valorem tax. An ad valorem tax is a tax that is based on the assessed value of a property product or service.

Real estate is perhaps the most common area where ad valorem tax is levied but it also extends to import duties and personal property. In contrast an ad valorem tax is a percentage tax based on the value added by the producer. Ad valorem is the most common type of tax since Import Duty Taxes Value Added Taxes Income Taxes and Property Taxes are generally ad valorem taxes.

17062021 Ad valorem taxes are taxes that are levied as a percentage of the assessed value of a piece of property. For example the import duty for a product classified under Harmonized System 220421 is 45 per cent of the customs valuation. Ad valorem is a phrase that comes from the Latin and means according to value.

Meanwhile most state governments collect ad valorem tax on tangible personal property most commonly on motor vehicles and business. Ad Valorem tax simply means a tax charged by state and municipal governments that depends on the assessed value of the asset such as real assets or personal property.

Chapter 11 Taxation Prices Efficiency And The Distribution

Ad Valorem Tax Evangel S Ib Economics Blog

Indirect Taxes 2021 Revision Update Tutor2u

Ad Valorem Tax Indirect Tax Tax Ads

Ad Valorem Tax Meaning Examples Top 3 Types

Do I Have To Pay Ad Valorem Tax Tax Walls

Fun Sources Ad Valorem Tax Diagram

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes