What Is The Meaning Of Risk Define Different Types Of Risk Briefly

30032019 However there are several different kinds or risk including investment risk market risk inflation risk business risk liquidity risk and more. Audit risk is the risk that auditors issued the incorrect audit opinion to the audited financial statementsFor example auditors issued an unqualified opinion to the audited financial statements even though the financial statements are materially misstated.

Solution Manual For Management Accounting Strategic Decision Making Performance And Risk 2nd Edition Solution Manual Fo Accounting Decision Making Management

We have liquidity risk sovereign risk insurance risk business risk default risk etc.

What is the meaning of risk define different types of risk briefly. Transfer of wagers can be executed through buying an insurance policy contractual agreements etc. Risk transfer in its true essence is the transfer of the implications of risks from one party individual or an organization to another third party or an insurance company. Risk definition is - possibility of loss or injury.

Pure risks are a loss only or at best a break-even situation. Listed below are the various types of Perceived risk. 18072018 Perceived risk can be of different types.

Generally the natural and physical risks are insurable risks eg businessmen can take a fire insurance policy to get protection from flood earthquake or from the damage of assets such as the bursting of boiler etc. When we think of loss as an investor we often think of the principal value of what we own decreasing in value but this type of risk called market risk is only one of many types of risks investors should consider along with the different types of risk management. Financial risks can be measured in monetary terms.

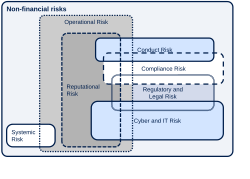

Compliance risk primarily arises in industries and sectors that are highly regulated. In general financial theory classifies investment risks affecting asset values into two categories. In other words the material misstatements of financial statements fail to identify or detect by auditors.

Functional Risk refers to the risks associated with the functioning of the product. Risk Probability of an accident Consequence in lost moneydeaths In contrast risk in finance is defined in terms of variability of actual returns on aninvestment around an expected return even when those returns represent positiveoutcomes. For example a consumer who loves to bake cakes for his family and friends might think Will the oven be sufficient to bake multiple batches of cakes.

Risk measures the uncertainty that an investor is willing to take to realize a gain from an investment. Many different definitions have. How to use risk in a sentence.

Broadly speaking investors are exposed to both. Risks are of different types and originate from different situations. It may also apply to situations with property or equipment loss or harmful effects on the environment.

The risks for which no protection is available are called Non-insurable risks. 3 Types of Risk in Insurance 3 Types of Risk in Insurance are Financial and Non-Financial Risks Pure and Speculative Risks and Fundamental and Particular Risks. Such risks may or may not necessarily take place in the future.

10072021 Risk is the chance or probability that a person will be harmed or experience an adverse health effect if exposed to a hazard. 11072018 Put simply risk is the possibility of loss. 25012012 However in financial management risk relates to any material loss attached to the project that may affect the productivity tenure legal issues etc.

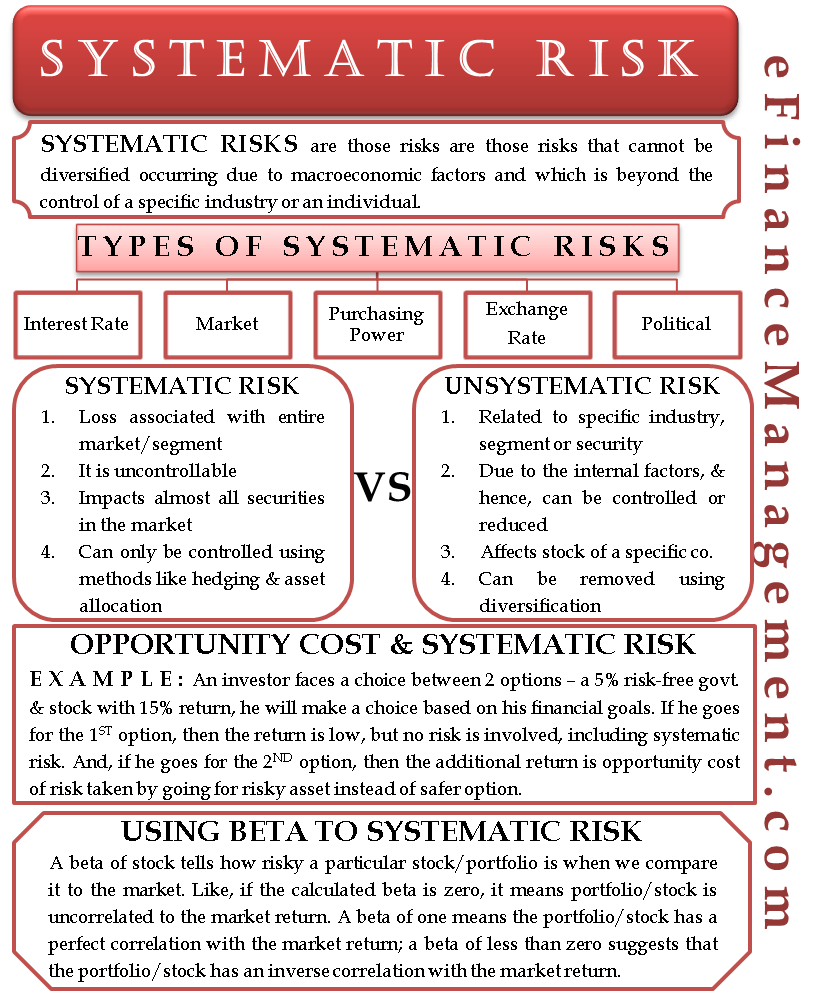

The risk of developing cancer from smoking cigarettes could be expressed as. 25022002 Risk involves uncertainty about the effectsimplications of an activity with respect to something that humans value such as health well-being wealth property or the environment often focusing on negative undesirable consequences. In finance different types of risk can be classified under two main groups viz Systematic risk.

Systematic risk and unsystematic risk. Various risks originate due to the uncertainty arising out of various factors that influence an investment or a. The second form of business risk is referred to as compliance risk.

Risk Management Examples That You Should Know

Risk Definition Types Adjusment And Measurement

Iso 31000 2018 En Risk Management Guidelines

Systematic Risk Vs Unsystematic Risk Top 7 Differences

Enterprise Risk Management Erm

Risk Analysis Risk Analysis Analysis Risk

/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)