What Is The Meaning Of Bond Payment

Fitch Ratings downgrades rating to A- on North Carolina bonds. 13122011 A Down Payment Bond is a form of a promise to pay guarantee that is issued on behalf of the purchaser to the seller for the purchase of real estate.

This down payment bond is accepted in lieu of cash when the purchaser must pay deposit monies to financially.

What is the meaning of bond payment. It stands to reason the higher the purchase price of your dream property the more youll have to pay towards your bond every month. This is the meaning when we say that a public utility issued or sold bonds to help finance a new power plant. A payment and performance bond is a type of contractual guarantee offered by a contractor to the owner of a property or asset for a specific project that the contractor is willing to do.

07112019 A payment bond is a type of surety bond issued to contractors which guarantee that all entities involved with the project will be paid. Principal Payment A principal payment is a payment toward the original amount of a loan that is owed. 26032019 A general obligation GO bond is a type of municipal bond in which the bond repayments interest and principal.

Sometimes bond prices go up and down meaning the price of your bond can change from what your face value is. A customs bond is an insurance policy that ensures that the United States government will be paid for your duties and taxes. In the industry they are often simply referred to as a bond Why do importers need one.

Shur -ih-tee bond can be defined in its simplest form as a written agreement to guarantee compliance payment or performance of an act. Defaults most often occur when the bond issuer has run out of cash to pay its bondholders. If the contracted party fails to fulfill its duties according to the agreed upon terms the contract owner can claim against the bond to recover financial losses or a stated default provision.

Other common names for these include construction. All the banks now offer 100 loans. The payment bond forms a three-way contract between the Owner the contractor and the surety to make sure that all subcontractors laborers and material suppliers will be paid leaving the project lien free.

A Payment Only Bond is rarely requested. 05012020 In the construction industry the payment bond is usually issued along with the performance bond. In other words a principal payment is a payment made on a loan that reduces the remaining loan amount due rather than applying to.

25052011 This is because the value of your bond can change over time and yield is the bonds annual coupon payment as a percent of its current value. A bond could be. All contract bonds guarantee the performance and or payment of the obligations under.

21052021 The bond will protect the client in the event that the contractor fails to fulfil its contractual obligations for example if the contractor becomes insolvent. The Bonds undertake that the Seller will refund any advance payments that have been made to the Buyer in the event that the product is unsatisfactory. He said the deal will help close the financial gap between what the city has to pay in terms of stadium bond payments.

A bond could be a formal debt instrument issued by a corporation or government and purchased by investors. The bond ensures that the contractor will complete the project as specified or face serious default penalties. 15072021 A bond default occurs when the bond issuer fails to make interest or principal payment within the specified period.

Surety is a unique type of insurance because it involves a three-party agreement. Bond paymentsare secured by a pledge of the obligated groups accounts receivable and a negative pledge of all other assets. A payment surety bond is a legal contract a type of bond that guarantees certain employees subcontractors and suppliers are protected against non-payment.

For example pretend you purchased a bond with a face value of 1000. Down payment Bonds are a form of a financial guarantee or simply put promise to pay. To riff on a popular saying the only things certain in importing are duties and taxes.

Once the bond reaches maturity the. 03082017 A surety bond pronounced. A bond is a fixed income instrument that represents a loan made by an investor to a borrower typically corporate or governmental.

A bond is also used to describe a guarantee of another persons obligation. An advance payment bond will normally be an on-demand bond meaning that the bondsman pays the amount of money set out in the bond immediately on demand without any preconditions having to be met. 15032020 Bonds are investment securities where an investor lends money to a company or a government for a set period of time in exchange for regular interest payments.

Similar to the former it can also. 14062017 A contract bond is a guarantee the terms of a contract are fulfilled. Since a default severely restricts the issuers ability to acquire financing in the future it is usually a last resort.

Do I need a deposit. Investors talk about investing in stocks and bonds. 18082020 The most commonly used refers to the original sum of money borrowed in a loan or put into an investment.

Advance Payment Bonds This will provide protection to the Buyer when an advance or progress payment is made to the Seller prior to completion of the contract.

All The 21 Types Of Bonds General Features And Valuation Efm

Coupon Bond Guide Examples How Coupon Bonds Work

/dotdash_Final_Bond_Apr_2020-01-63d1901859ed40f5bc7533de1a31e857.jpg)

Bond Definition Understanding What A Bond Is

How To Calculate A Coupon Payment 7 Steps With Pictures

Pin On Surety Bond Terms Glossary

What Is A Bond Types And How Do They Work Scripbox

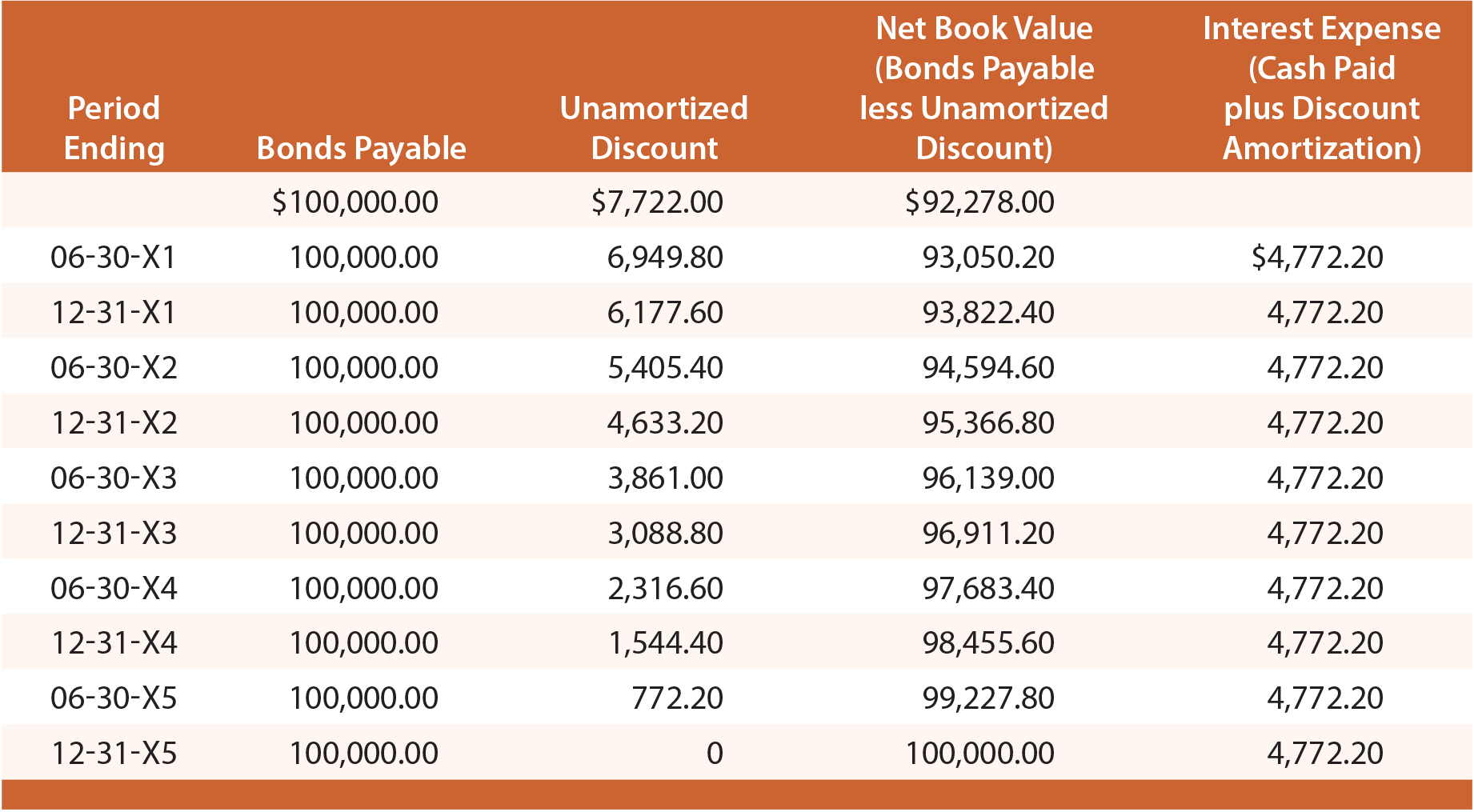

Discount Bond Bonds Issued At Lower Than Their Par Value

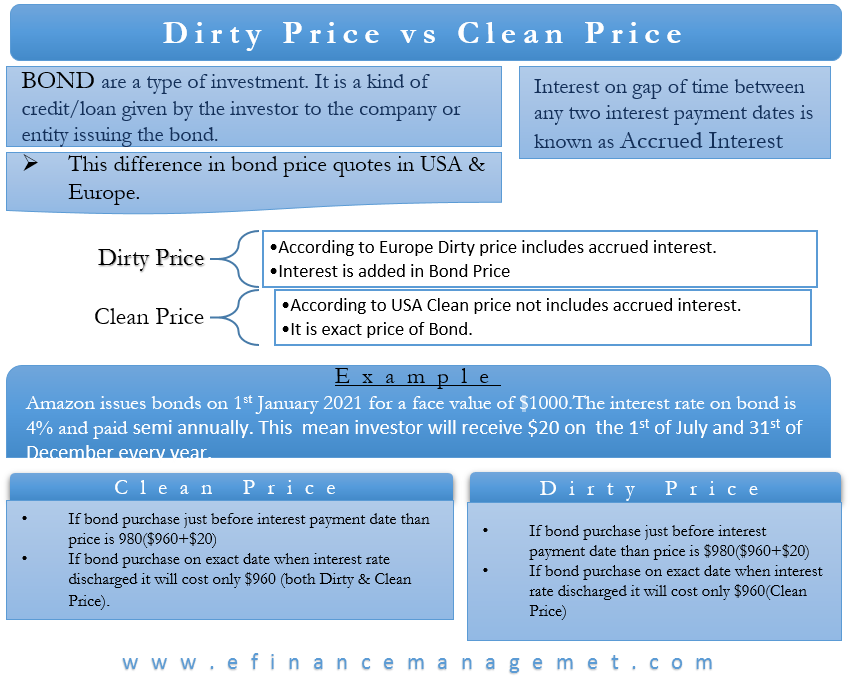

Dirty Price Vs Clean Price Concept Difference Efinancemanagement

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity