What Is The Meaning Of Salary Components

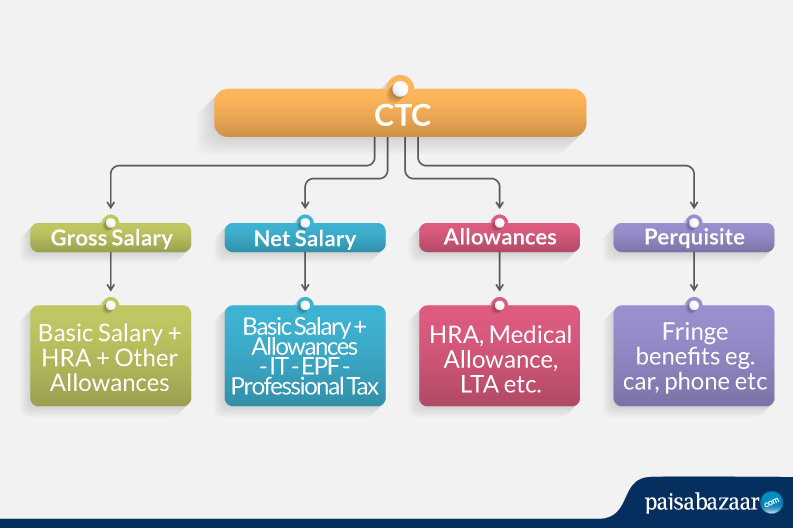

Gross salary is the monthly or yearly salary of an individual before any deductions are made from it. 05082020 It refers to the total salary package of the employee.

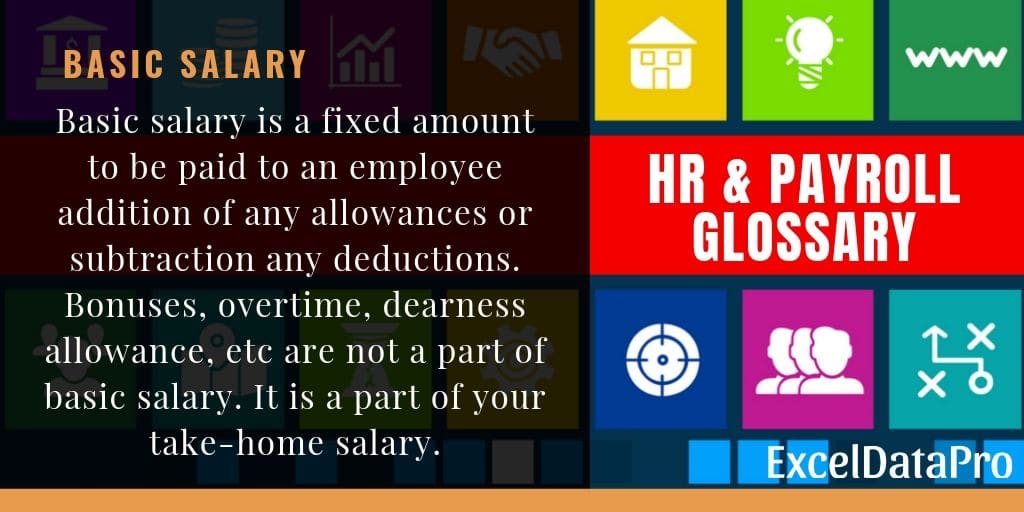

What Is Basic Salary Definition Formula Income Tax Exceldatapro

Building up MVC gradually from wage increase A company set aside the full amount of wage increase to build MVC Year Basic salary Wage increase New Salary MVC MVC Amount Y1 1000 35 1035 3 1035 x 3 31.

What is the meaning of salary components. Knowing the value of separate components can form the basis for maximizing your income tax savings for the applicable financial year. For example you give an employee a yearly salary of 28600. 30112015 A salary is a fixed amount that you can pay an employee.

13052017 The first item is base pay which is just one aspect of the overall gross compensation. However this is usually the bulk of any employees payroll. This is the simplest way by which you can define salary as it involves just arbitrarily allocating some amount to each of the heads.

It is the base of your pay structure. Salary components can be defined using a number of ways. As the name suggests it is the basic component of your salary and it constitutes 40-50 of your total pay.

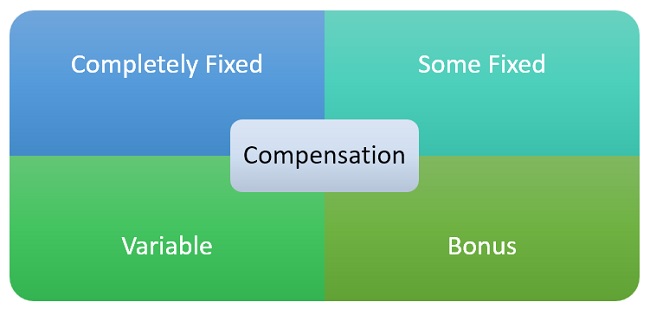

Salary packages typically include your base salary as well as additional benefits incentives or rewards such as superannuation annual and sick leave car allowance or bonuses. 13122012 Take a look at its effect on your salary with one example. That might have different tax treatments.

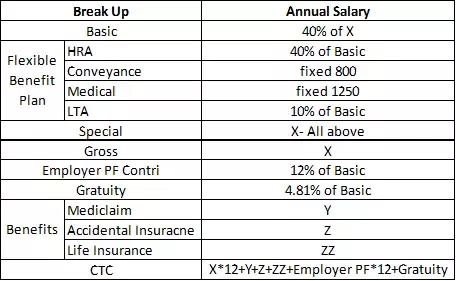

Salary structure is the details of the salary being offered in terms of the breakup of the different components constituting the compensation. Components Employers can build up MVC from. Other components of your total pay are calculated depending on your basic pay.

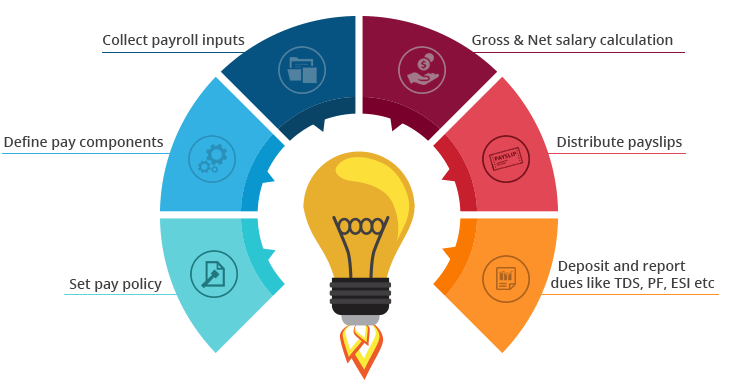

CTC is never equal to the amount of take-home salary of the employee. Sometimes you need to give salary based on. So let us discuss some of those methods.

Like other parts of the salary structure they can be grouped into five common types namely cash bonuses and allowances. It is up to the individual employer whether they advertise. Components that form a part of Gross salary are listed below.

This is similar to salary. Annual basic is the monthly basic pay multiplied by twelve months. With a salary package money is usually deducted from your salary before tax for these items or services.

And annual components such as gratuity annual variable pay annual bonus etc. Theres generally 3 main types of gross pay. Components such as basic salary house rent allowance provident fund leave travel allowance medical allowance Professional Tax etc.

You salary contains various components such as Basic HRA transport allowance medical allowance leave travel allowance etc. These components include Annual Gratuity Employee Contribution to Provident Fund or ESIC are determined according to your basic. Allowances such as the travel allowance medical allowance leave travel allowance etc.

The salary paid to employees comprises of a number of different components such as basic salary allowance perquisites etc. Or 2 wage increase and existing monthly basic salary Example 1. Typically an employee is given a yearly salary which is then divided by the number of pay periods in the year.

21122006 The variable component of the salary is delivered in many different ways. CTC is inclusive of monthly components such as basic pay various allowances reimbursements etc. Employees get paid the same fixed amount each payroll regardless of their attendance.

1 Basic-Rs30000 2 Conveyance Allowance-Rs8000 3 Medical Allowance-Rs4000 and 4 Night Shift Allowance-Rs4000. Annual Basic Monthly Basic X 12. 20042021 Why is Salary Slip important.

Benefits like rent for accommodation electricity fuel charges and water. Off-hand what the FBT says is to tax all of the financial transactions which happens due to an employee be it business related hence taxed by the employer or salary component -the tax component being passed on to the employee. Are some of the.

Other components such as the salary arrears remuneration or fee overtime payment and performance related cash awards. This component tends to. This is the type of salary definition which we come across most often.

You pay the employee every week which means the weekly paycheck will be 550 before deductions 28600 52 weeks. Suppose below are the few salary components then what is your current contribution and what will be your future contribution.

Understanding The Salary Slip Pay Slip Format Download Components

Financial Components At Hcl Ppt Download

Salary Structure Definition Importance Example Human Resources Hr Dictionary Mba Skool Study Learn Share

New Wage Code How Your Salary Structure Will Change Businesstoday

Compensation Definition Importance Human Resources Hr Dictionary Mba Skool Study Learn Share

Salary Structure Components How To Calculate Take Home Salary

Salary Structure In India Different Types And Components

What Is The Salary Structure Of Your Company Quora