What Is The Meaning Of Bond Outstanding

In finance a bond is an instrument of indebtedness of the bond issuer to the holders. In cases where the financial resources of the principal are in doubt the fee will be quite high or the surety will insist that all or most of the bond be kept in escrow during the term of the bond.

40 Outstanding Eye Tattoos Plus The Meaning And Rich History Behind Them Tattoo Insider All Seeing Eye Tattoo Eye Tattoo Tattoos

24052018 It refers to a buyback of bonds previously sold.

What is the meaning of bond outstanding. For example on a companys cash statement retirement of. After redemption the debt has no value and pays no more interest. The outstanding amount is the key financial amount of the part of the loan.

The way it is spread is determined by the ratio of the bonds outstanding at a given moment to the. Outstanding Bonds means all Bonds which are deemed to. In addition the issuer might have to repay the principal at a later date which is termed the maturity.

The amount owed on a debt as of a particular date. There are different sources that report the outstanding amounts. Straight bonds on their number of new issues issue and redemption amounts as well as outstanding balances with the aim of providing a measure for the general public to better understand the scale of the public and corporate bond market.

Definitions Government Bonds are coupon or discount bonds issued and redeemed by the government. Title companies will obtain an outstanding balance for liens on property being soldas of the anticipated date of closing with a daily accrual for additional interest due each day the closing is delayed. That means their market value will typically be different from their maturity value.

Total Public Debt Subject to Limit is defined as the Total Public Debt Outstanding less the Unamortized Discount on Treasury Bills and Zero-Coupon Treasury Bonds old debt issued before 1917 and old currency called United States Notes as well as Debt held by the Federal Financing Bank and Guaranteed Debt. Any portion of bonds that are not yet paid back would be considered outstanding until they are paid in full with interest. You can take care of this process yourself or use the services of a bond originator.

Most debt consists of bank loans corporate bonds and. Shares outstanding refer to a companys stock currently held by all its shareholders including share blocks held by institutional investors and restricted shares owned by the companys insiders. 15042020 Outstanding bonds are those bonds that have been purchased by an investor and have not yet been paid back by the company to the investor.

26082010 You will need this document to apply for a loan at a bank. The time to maturity for LTD can range anywhere from 12 months to 30 years and the types of debt can include bonds mortgages. 02082019 The outstanding debt definition for a business is the total of all principal amounts owed to lenders plus interest that the borrowed amounts have earned but that hasnt been paid.

In other words it means a bond issuer has paid off the debt represented by the bonds. Apply at more than one institution to make sure you get the best deal. It is a debt security under which the issuer owes the holders a debt and depending on the terms of the bond is obliged to pay them interest the coupon.

Outstanding Bonds means the aggregate value of the total number of Bonds not redeemed or otherwise discharged. Sovereign bond yield is the interest rate paid to the buyer of the bond by the government or sovereign entity issuing that debt instrument. This is true even if the market value of the bond fluctuates during the course of its life.

You can expect to receive the maturity value at the specified maturity date barring a default. A bond originator can negotiate with banks on your behalf to ensure you get the best offer and interest rate. Between 2 installments this amount is increasing everyday with the daily interest then is coming back to zero on the due date when the installment has to be paid.

Its the amount you pay when you buy if you buy without extra cost or discount. The debt issuer -- a governmental entity or corporation -- redeems the debt upon maturity by paying the face value and any remaining interest due. In some situations an issuer may.

22032020 Long Term Debt LTD is any amount of outstanding debt a company holds that has a maturity of 12 months or longer. 14062021 Bonds trade on the open market from their date of issuance until their maturity. Outstanding Bonds means the Bonds not redeemed or otherwise discharged.

Bond Outstanding Method In accounting a way to amortize the discount or premium of a bond s par value by spreading it out over the course of its life. It is classified as a non-current liability on the companys balance sheet. 15042021 In exchange for this service the principal pays a fee to the surety for as long as the surety bond is outstanding.

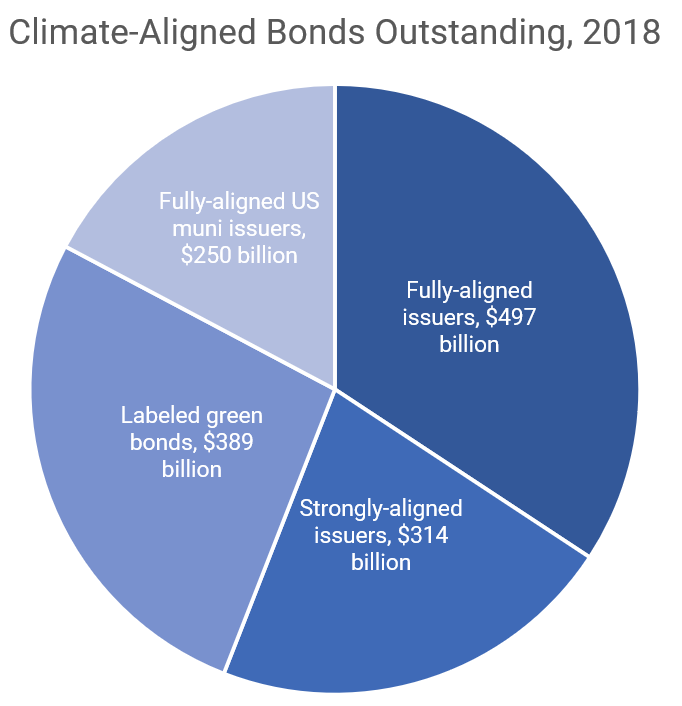

Bond market has outstanding bonds that are approximately 312 trillion dollars.

My Mom Is More Then A Fearless Women She S More Then A Super Hero Love Mom Quotes Mom And Dad Quotes Love My Mom Quotes

Green Bonds Are Growing Fast But There Are Challenges Intuition

Pin By Tiki Bond On Tattoo You Feather Tattoo Foot Tattoos Feather Tattoo Meaning

Parker Jotter Bond Street Black Ballpoint Pen Chrome Trim Parker Jotter Best Ballpoint Pen Pen

Storytelling Storytelling Books Playschool

True In Every Aspect Of Life Relationships Business Health Etc Quotes Quote Comfortable Unco Quotes To Live By Encouragement Quotes Financial Quotes

You Can T Buy Fun But You Can Download It Run With Me Bond Bad

Heartfelt Quotes The Brain Is The Most Outstanding Organ It Works For 24 Hours 365 Days Right Fr Old Love Quotes Love Friendship Quotes Love Quotes For Him