What Is The Meaning Of Portfolio Diversity

Diversification works because these assets react differently to the same economic event. This frees up your time to pursue other matters and reduces the market stress that may lead to burnout.

Why Portfolio Diversification Matters Sofi

It provides insight into your personality and work ethic.

/TheDangersOfOver-DiversifyingYourPortfolio-1171d85499d6461ea916884a50c8c25d.png)

What is the meaning of portfolio diversity. What is Portfolio Diversification. If you own just one investment property and its not tenanted then you are getting absolutely zero rental income because no one is renting it. Diversification is the practice of spreading your investments around so that your exposure to any one type of asset is limited.

One of the keys to successful investing is learning how to balance your comfort level with risk against your time horizon. 17022021 A diversified portfolio is a collection of investments in various assets that seeks to earn the highest plausible return while reducing likely risks. Portfolio Diversification refers to choosing different classes of assets with the objective of maximizing the returns and minimize the risk profile.

As the name suggests the basic definition of portfolio diversification is that it involves spreading investments across a broad selection of assets in order that losses in one part of the portfolio are offset by gains elsewhere. 09022020 Diversifying investments is touted as reducing both risk and volatility. A Property Portfolio Gives You Multiple Streams Of Income And the last benefit that I am going to share with you today is a property portfolio gives you multiple streams of income.

Owning investments across different funds ensures that industry-specific and enterprise-specific risks are low. A diversified portfolio minimizes the overall risk associated with the portfolio. Once you have your investments settled into a wide variety of stocks and securities they can remain there for extended periods without requiring a lot of maintenance.

03062021 It is a management strategy that blends different investments in a single portfolio. A diversified portfolio is a portfolio constructed of investment products with different risk levels and yields which seeks to lower the assumed risk and leverage a significant percentage of the variability of the portfolio performance. 19122012 As noted by Brian Breidenbach CFA in a report by the Consumer Federation of America investing in a bunch of different mutual funds can sometimes give a false impression of diversity.

Since investment is made across different asset classes and sectors the overall impact of market volatility comes down. Markets tend to work in cycles and different markets may go up or down at different times. Thus it reduces risks and generates higher returns in the long run.

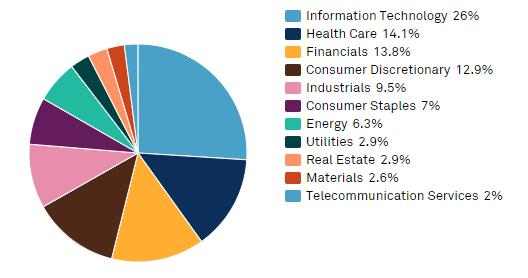

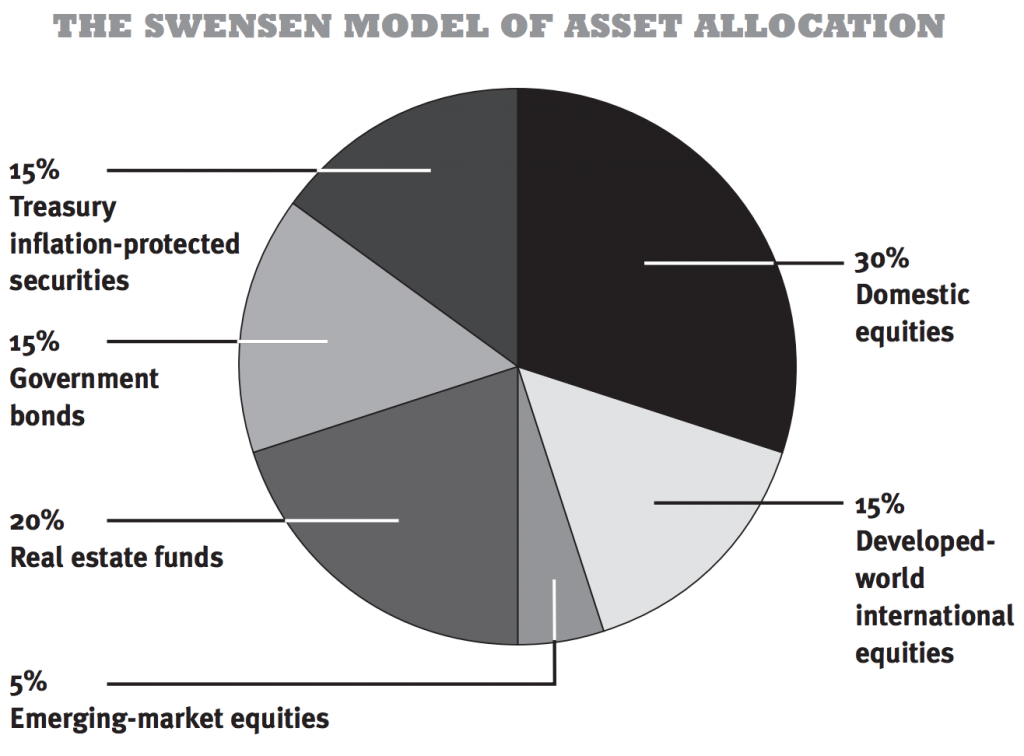

I understand portfolio diversity as investing in various sectorsmarkets. Why should I have a portfolio. 14042020 By far the most popular form of diversification is asset allocation.

Each investor has his own risk profile but there is a possibility that he does not have the relevant investment security that matches his own risk profile. 23032018 Generally speaking a diversified portfolio contains at least 20 different stocks. The process of putting together a portfolio itself will help you become a more effective intervieweeYou will be identifying the skills you have gained through your various.

A portfolio is a compilation of materials that exemplifies your beliefs skills qualifications education training and experiences. A typical diversified portfolio has a mixture of stocks fixed income and commodities. Basically portfolio diversity means having good number stocks from different companies in your portfolio.

Is it the diversity of my purchase prices. For all of my purchased stocks there is a section that says portfolio diversity with a percentage next to it. 15012021 With a diversified portfolio the idea is that the more varied your collection of asset classes and funds the better it can mitigate losses.

This practice is designed to help reduce the volatility of your portfolio over time. While a diversified portfolio may lower your overall risk level it. 17102018 A diversified portfolio is less exciting and more stable.

By having elements of different investment classes in your portfolioincluding stocks bonds cash real estate gold or other commoditiesyou can protect your portfolio from losing the value that it might if it only contained one failing asset category. How is it that each different stock I own has a different percentage. The idea behind diversification is that a variety of investments will.

However its hard to keep track of 20 different investments tracking reading the prospectuses comparing them to their peers etc. 07012021 Portfolio diversity is one of the basic tenets of successful long-term investing but diversity goes beyond just having stocks and bonds in your portfolio. Where have you heard about portfolio diversification.

A Detailed Diversification Strategy Part Ii The Aggressive Investor Seeking Alpha

How To Build A Dividend Portfolio Intelligent Income By Simply Safe Dividends

/TheDangersOfOver-DiversifyingYourPortfolio-1171d85499d6461ea916884a50c8c25d.png)

The Dangers Of Over Diversifying Your Portfolio

The Risk And Return Relationship Part 2 Capm Acca Qualification Students Acca Global

Diversification Definition And Meaning Capital Com

Role Of Correlation In Portfolio Diversification Mymoneysage Blog

Maximizing Your Portfolio Benefits Via Asset Allocation

Diversified Portfolio Examples I Will Teach You To Be Rich

Six Types Of Diversification To Include In Your Portfolio