What Is The Meaning Of Code Tax

14012020 A tax code is a sequence of letters and numbers that help you determine how much tax you should be paying. This code is usually applied on a Week 1Month 1 basis meaning that an employees tax calculation is based solely on what they are paid in the current pay period and disregards their earnings in the year to date.

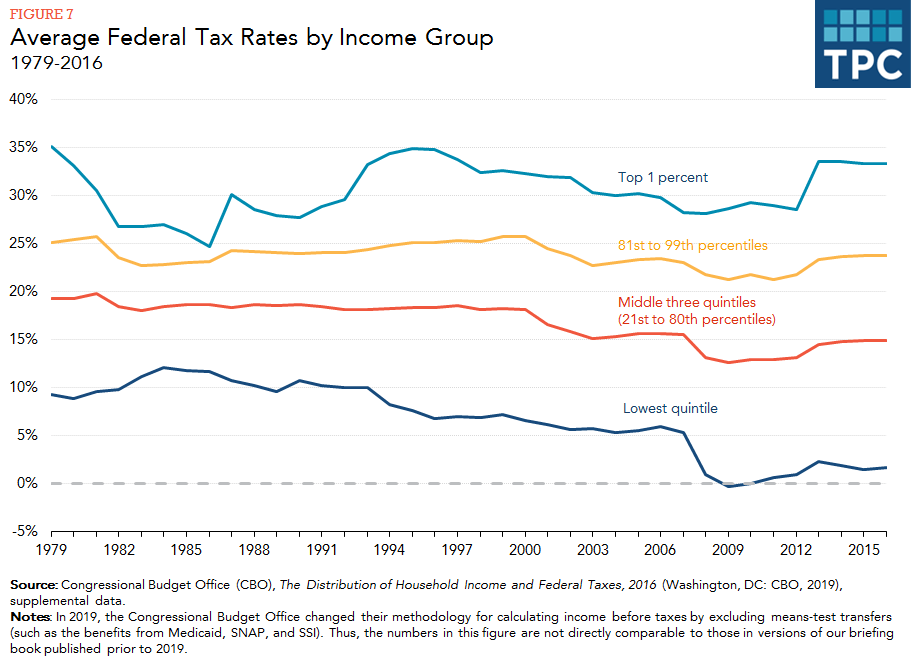

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

The code tells you how much you can earn before you have to.

What is the meaning of code tax. Your relationship status and any dependents you might have. This therefore results in tax code 1257L. An ECC computer-generated debit for the amount of overpayment credit transferred to another tax module within this taxpayers account.

The Internal Revenue Code formally the Internal Revenue Code of 1986 is the domestic portion of federal statutory tax law in the United States published in various volumes of the United States Statutes at Large and separately as Title 26 of the United States Code. Each tax explanation code specifies a particular algorithm that affects. Therefore if you have a tax code 1257L it means that you can earn 12570 before you pay tax.

They drop the last digit which gives 1257. If your tax code was 1250L it means your allowance was 12500. For example if you are paid weekly your allowance is equivalent to 240 per week.

21 rows Letters in an employees tax code refer to their situation and how it affects their. Tax code 1257L The most common tax. 21 rows What your tax code means Your tax code is made up of several numbers and a letter.

If youre paid monthly its 1042 per month. The tax claim code. This is also used as the emergency tax code when a new employee doesnt have a P45.

HM Revenue and Customs HMRC will tell them which code to. 14062021 This is the most common tax code and is used for most people with one job and no untaxed income unpaid tax or taxable benefits for example a company car. Tax codes are regulated by HMRC and they can differ based on your circumstances the system works by taking the amount of tax you owe off your salary before you receive it.

That enables them to calculate how much tax-free income you can get in each tax year. A tax code is a federal government document usually numbering thousands of pages that details the rules individuals and businesses must follow in remitting a percentage of their incomes to the. HMRC convert the personal allowance of 12570 and turn it into tax code 1257L.

Tax explanation codes are hard-coded values that exist in the Tax Explanation Codes 00EX user-defined codes UDC table. They work out how much tax free Personal Allowance you have. These codes specify the algorithm that the system uses to calculate the tax amount and which if any GL account is used to record tax information.

15042021 The tax code is used for most people with one job and no untaxed income unpaid. Two aspects of taxes follow from this definition. This is the code that matches your situation eg.

Overall tax compliance involves being aware of and observing the state federal and international tax laws and requirements set forth by government officials and other taxing authorities. It is given to you in equal portions throughout the year so that by the end of the tax year you have received your full allowance. If the tax code changes during the year HM Revenue and Customs HMRC will email you - you should update your payroll records as soon as possible.

The first step takes place by HM Revenue and Customs. 16072021 According to the IRS Master File Codes here is the meaning of tax code 826 on your transcript. Meaning Of TC 971.

The tax code numbers give specific information to employers and to pension providers. 1 A tax is a compulsory payment and no one can refuse to-pay it. 24072017 In order to be eligible for the tax rebate youll often be asked for a code.

The meaning of the numbers in a tax code is the important part. The corresponding credit is code 706. 03032020 Every year the taxman sends out around 28 million tax codes to employees and pensioners with the bulk landing around this time of year.

Your tax code is used by your employer or pension provider to work out how much Income Tax to take from your pay or pension. There two codes youll need are as follows. A tax is a compulsory payment levied on the persons or companies to meet the expenditure incurred on conferring common benefits upon the people of a country.

It is organized topically into subtitles and sections covering income tax in the United States payroll taxes estate taxes gift taxes and excise taxes. The letter L is then added if you are entitled to the standard personal allowance. A basic example here is the annual April deadline for tax return filing.

How are tax codes worked out.

My Tax Code Is 1250l What Does It Mean

How Do Taxes Affect Income Inequality Tax Policy Center

Tax Codes Explained What My New Code Means And Full List Of Hmrc Changes For 2021 22

/Howarecapitalgainsanddividendstaxeddifferently2-aa1e45473ab6480185b77281959dee5c.png)

How Are Capital Gains And Dividends Taxed Differently

Tax Codes Explained What You Need To Know About Tax Codes Reed Co Uk

If You Haven T Filed Your 2018 Tax Returns You Re Not Alone The Latest Irs Stats Show Both Filings And Processing Are Down C Income Tax Return Tax Return Tax

Step By Step Document For Withholding Tax Configuration Sap Blogs

Individual Income Tax In Malaysia For Expatriates

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcr3xnnn4pgn7z1kevzmr4i9oyfoz42ojvvlecxtuwu Usqp Cau