What Is Zero Coupon Bond Meaning In Hindi

That definition assumes a positive time value of money. A zero coupon bond also discount bond or deep discount bond is a bond in which the face value is repaid at the time of maturity.

Promo Code Meaning In Hindi 07 2021

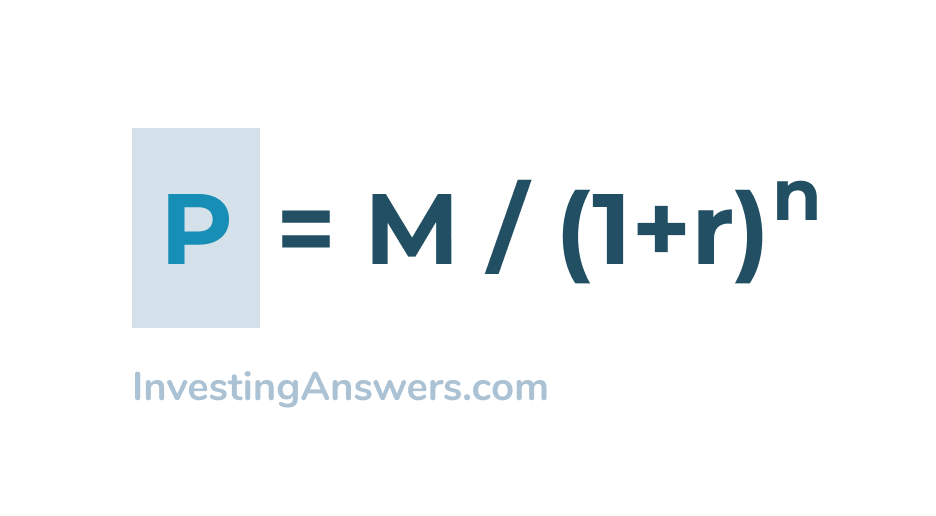

This would represent the return on an investment in a zero coupon bond with a particular time to maturity.

What is zero coupon bond meaning in hindi. The funds raised through issuance of these instruments which are a variation of the recapitalisation bonds issued earlier to public sector banks are being deployed to capitalise the state-run bank. Instead investors receive the gain of the appreciated bond at maturity. 15122019 A zero coupon bond is a type of bond that doesnt make a periodic interest payment.

Zero-Coupon Bond Also known as Pure Discount Bond or Accrual Bond refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment unlike a normal coupon-bearing bond. Written by Sunny Verma Sandeep Singh New Delhi. The bonds which are backed up by the real estate companies and equipment are called mortgage bonds.

For example a 91 day Treasury bill of Rs100- face value may be issued at say Rs. Bonds are kinds of debts or IOUs that corporations and governments sell and investors buy. 08072019 While most bonds pay investors annual or semi-annual interest payments some bonds referred to as zero-coupon bonds do not pay interest at all but are instead issued at a deep discount to par.

In bond investing the term coupon refers to the interest rate repaid periodically to the bondholder. 08121997 Moorad Choudhry in The Bond. When the coupon rate is zero and the issuer is only applicable to repay the principal amount to the investor such type of bonds are called zero-coupon bonds.

A zero-coupon bond as the name suggests it is a financial instrument which does not allow a regular interest payment to the investor. In other words its annual implied interest payment is included in its face value which is paid at the maturity of such bond. A zero-coupon bond also known as an accrual bond is a debt security that does not pay interest but instead trades at a deep discount rendering a profit at maturity when the bond is redeemed.

It does not make periodic interest payments or have so-called coupons hence the term zero coupon bond. When the issuer continues to pay back the loan amount to the investor every year in small instalments to reduce the final debt such type of bond is called a Serial Bond. A zero-coupon bond also discount bond or deep discount bond is a bond bought at a price lower than its face value with the face value repaid at the time of maturity.

25072019 A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. Zero-coupon bonds present an investor with the certainty that the rate of return earned on reinvested interest payments will be zero because no payments will be available for reinvestment. It does not make periodic interest payments or have so-called coupons hence the term zero-coupon bond.

A zero-coupon bond also known as a discount bond is a type of bond that is purchased at a lower price than its face value. 05052016 Treasury bills are zero coupon securities and pay no interest. Rather they are issued at a discount at a reduced amount and redeemed given back money at the face value at maturity.

The zero coupon yield curve shows in graphical form the rates of return on zero coupon bonds with different. The zero coupon rate is the return or yield on a bond corresponding to a single cash payment at a particular time in the future. Zero-coupon bonds are also popular in the corporate market indeed corporate zero-coupon bonds differ from zero-coupon bonds in government markets in that they are actually.

9820 that is at a discount of say Rs180 and would be redeemed at the face value of Rs100-. Floating-rate bonds were reviewed in Chapter 5. Treasury bills are an example of a zero-coupon bond.

These bonds are sold at a discount dont pay a standard monthly interest percentage like normal bonds do. The face value is repaid when the bond reaches maturity. Corporate bonds pay a fixed or floating-rate coupon.

This way the company or government doesnt have to worry about changing interest rates. A Zero coupon bond is a bond that sells without a stated rate of interest. 01012021 Zero coupon bonds.

Zero-coupon bonds accumulate interest each period until they become worth their face value on the scheduled maturity date. January 1 2021 124528 pm. It is also called a pure discount bond or deep discount bond.

Moreover it is a bond which is issued at a meagre market price discounted price in comparison to its face value. 1452 Bond interest payment.

Zero Coupon Bonds Or Deep Discount Bonds In Hindi Youtube

Promo Code Meaning In Hindi 07 2021

Coupon Definition And Meaning Market Business News

Zero Coupon Bond Meaning Youtube

Zero Coupon Bond Definition And Example Investing Answers

Coupon Coupon Rate Meaning In Hindi

Promo Code Meaning In Hindi 07 2021

Promo Code Meaning In Hindi 07 2021

French Translation Of Coupon Collins English French Dictionary