What Is The Meaning Of Zero-coupon Bond

Hence they trade at a deep discount. A zero coupon bond also discount bond or deep discount bond is a bond in which the face value is repaid at the time of maturity.

And it is redeemable on or after a specified maturity date at the par value itself.

What is the meaning of zero-coupon bond. It does not make periodic interest payments or have so-called coupons hence the term zero coupon. Zero coupon bond Noun A bond eg corporate debenture or government debt that has no coupon ie pays no interest during the life of the issue. 02072021 Zero coupon bonds are bonds that do not make any interest payments until maturity you wont put a single penny of interest in your pocket for two decades.

The rate of return to the holder is derived from the gradual appreciation as the security moves toward maturity. A zero-coupon bond as the name suggests it is a financial instrument which does not allow a regular interest payment to the investor. In other words its a bond that sells for less than its face value and does not make coupon payments or periodic interest payments during its life.

Moreover it is a bond which is issued at a meagre market price discounted price in comparison to its face value. These bonds come with 10-15 years maturity. Zero coupon bonds are bonds that do not pay interest during the life of the bonds.

Zeros-coupon bonds are ideal for long-term targeted financial needs. A zero-coupon bond is issued at a fraction of its par value perhaps at 3 to 5 for each 100 of face value for a long-term bond and increases gradually in value as it approaches maturity. The face value is repaid when the bond reaches maturity.

A zero-coupon bond also known as a discount bond is a type of bond that is purchased at a lower price than its face value. That definition assumes a positive time value of money. 25072019 A zero-coupon bond is a bond that pays no interest.

At the time of maturity the investor is paid the face value or par value. 09052020 A zero coupon bond is a type of bond that doesnt make a periodic interest payment. The buyer of the bond receives a return by the gradual appreciation of the security which is.

Thus an investors income from a zero-coupon bond comes solely from appreciation in value. Such a bond is initially sold at a discount to its face value. A zero-coupon bond also known as an accrual bond is a debt security that does not pay interest but instead trades at a deep discount rendering a profit.

A zero-coupon bond has no periodic interest payments meaning that it. Zero-coupon bonds are subject to very large price fluctuations. A Zero Coupon Bond is a debt security that is sold at a discount and does not pay any interest payments to the bondholder.

25092020 Zero coupon bonds are fixed income securities that dont pay any interest. In bond investing the term coupon refers to the interest rate repaid periodically to. Bonds are kinds of debts or IOUs that corporations and governments sell and investors buy.

Reinvestment risk is not relevant for zero-coupon bonds but interest rate risk is relevant for the bonds. Zero-Coupon Bond Also known as Pure Discount Bond or Accrual Bond refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment unlike a normal coupon-bearing bond. Information and translations of zero-coupon bond in the most comprehensive dictionary definitions resource on the web.

25112020 A zero-coupon bond doesnt pay periodic interest but instead sells at a deep discount paying its full face value at maturity. Instead investors buy zero coupon bonds at a deep discount from their face value which is the amount the investor will receive when the bond matures. 20052021 A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value.

In other words its annual implied interest payment is included in its face value which is paid at the maturity of such bond. Meaning of zero-coupon bond. What does zero-coupon bond mean.

The bond trades at a discount to its face value.

Journal Entry For Zero Coupon Bonds Accounting Education

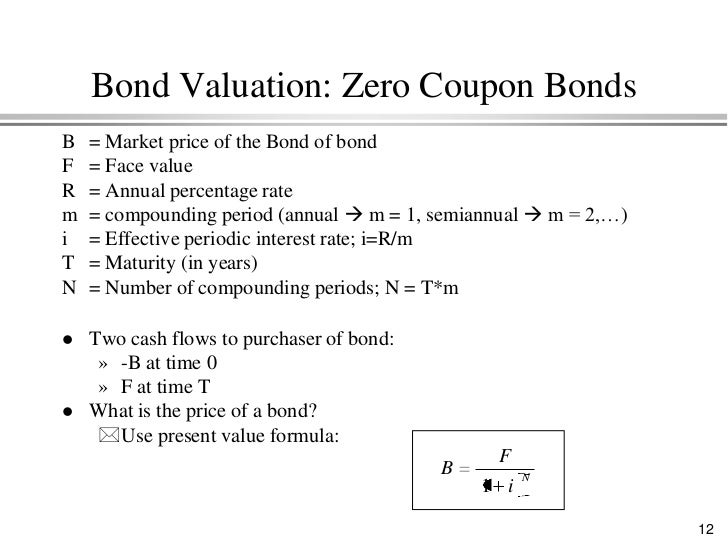

Valuing Bonds Lecture 6 Online Presentation

What Is A Zero Coupon Bond Definition Features Advantages Calculation Example Limitations Treatment Of Income The Investors Book

Alexander Nunez Torres Phd Ppt Download

Bonds Bond Prices Interest Rates And Holding Period Return Ppt Download

Example Regarding Zero Coupon Bonds Quantitative Finance Stack Exchange

Zero Coupon Bond Definition How It Works Formula

How Do I Calculate Yield To Maturity Of A Zero Coupon Bond

Coupon Coupon Bond Vs Zero Coupon Bond