What Is The Meaning Of A Bond Yield

So an investor who purchased 10000 of these bonds at their issue will receive 4375 the coupon rate a. Continuing with the above illustration we know that the investor bought the bond for Rs100.

Relationship Between Bond Prices And Interest Rates Finance Capital Markets Khan Academy Youtube

The less you pay for a bond the greater your profit will be and the higher your yield will be.

What is the meaning of a bond yield. The yields are paid by the US. 08022021 While the stock market soared as bond yields hit historic lows last year equities can conversely suffer here from higher yields as bonds start to offer more competition to yield-seeking investors. Therefore bond yield or return 10100 100 10.

Bond yield is the amount of return an investor will realize on a bond calculated by dividing its face value by the amount of interest it pays. Measuring the direction of bond yields over time is one way to try to. 20022018 Bond yield meaning.

But what does this mean. When looking at true fixed-rate bonds or XTBs over them Running Yield is not the best metric to consider when youre making an investment. The interest rate is fixed at Rs10.

As mentioned bond yield is the amount of return realised on a bond. The major factors affecting the yield is the monetary policy of the Reserve Bank of India especially. 28032020 A bonds yield is the discount rate that links the bonds cash flows to its current dollar price.

Government security means returns that investors get for their bond loans. A bonds yield is the return an investor expects to receive each year over its term to maturity. The lower the price the higher the yield and vice versa.

23032021 Treasury bond yields or rates are tracked by investors for many reasons. Government as interest for borrowing money via selling the bond. The bond yield is a return on investment expressed as a percentage for a bond.

25022021 Bond yield is the return an investor gets on that bond or on a particular government security. Bond A has a price of 1000 with a coupon payment of 4 and its initial yield to maturity is 4. Bond yield is the amount of return realised on a bond.

Rising yields on government securities or bonds in the United States and India have triggered concern over the negative impact on other asset. In general riskier bonds have higher yields. Over the course of the following year the yield on Bond A has moved to 45 to be competitive with prevailing rates as reflected in the 45 yield on Bond B.

The income one receives from a bond investment rather than its capital appreciation. -Maturity represents the day the bond will be paid back. 22032011 Bond yields are a measure of the profit you will make from your bond investment.

26022021 Article continues below advertisement A bond yield on a US. For the investor who has purchased the bond the bond yield is a summary of the overall return that accounts for the remaining interest payments and principal. 14072021 Bond yield is the amount of return an investor will realize on a bond calculated by dividing its face value by the amount of interest it pays.

-Coupon represents the Yield of the bond at par value or the price the bond was initially offered at which is usually 100. 30052021 Heres how the math works. Conversely the more you pay for a bond the smaller your profit will.

It can be calculated as a simple coupon yield which ignores the time value of. This is due to the certainty in their cash flows the exact cash flows are determined on the issuance date by. The yield is calculated as the coupons the investor receives in a year expressed as a percentage of the cost of the investment.

A bonds yield is the return to an investor from the bonds coupon interest payments. A rising bond yield means heightened returns. In other words they are interest rates offered by bonds.

When inflation is expected to increase interest rates increase as. 04032021 Bond yield is the return an investor gets on that bond or on a particular government security. The bond yields are inversely related to the bond prices.

In other words it pays out 40 of interest each year.

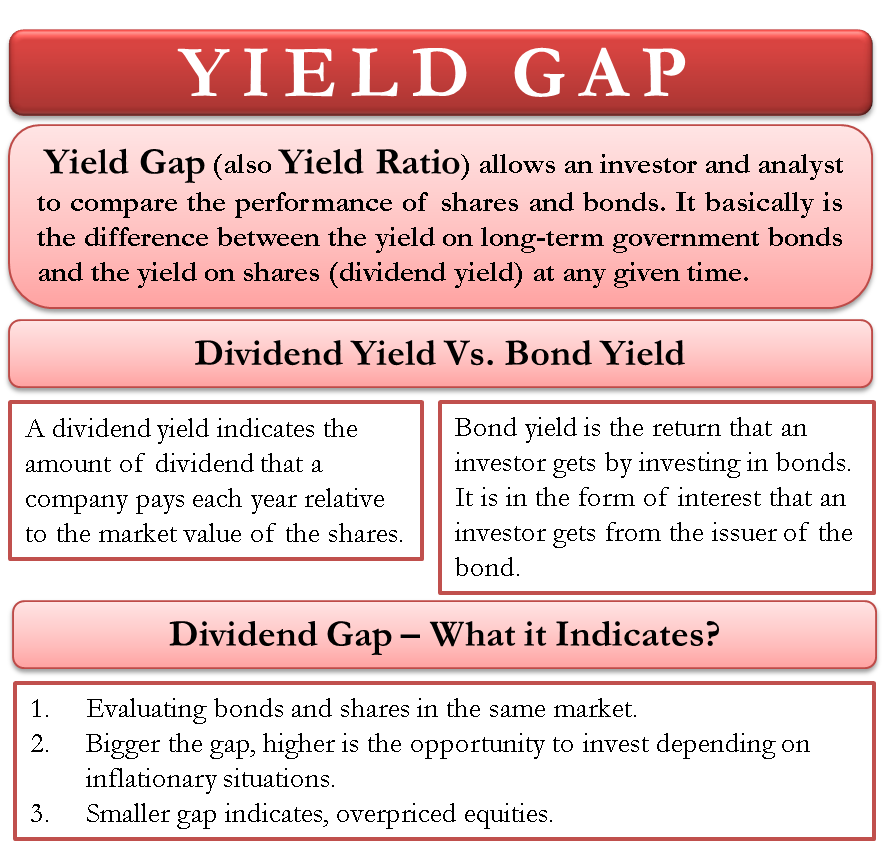

Yield Gap What It Means And How To Interpret It

:max_bytes(150000):strip_icc()/dotdash_Final_The_Predictive_Powers_of_the_Bond_Yield_Curve_Dec_2020-02-2c724203ef1e41ce82291df3676bb392.jpg)

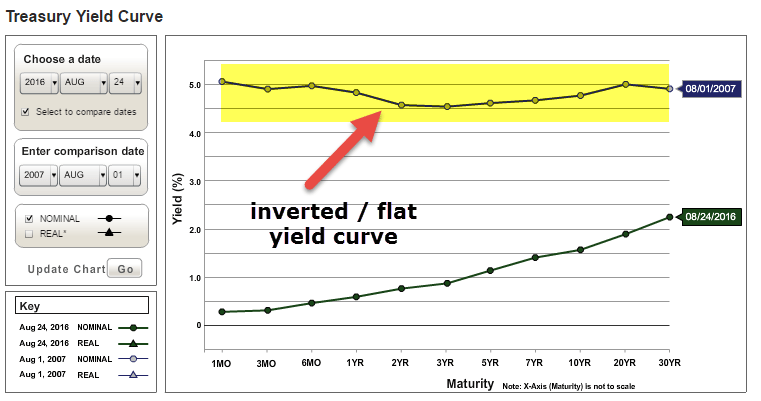

The Predictive Powers Of The Bond Yield Curve

Bond Prices Rates And Yields Fidelity

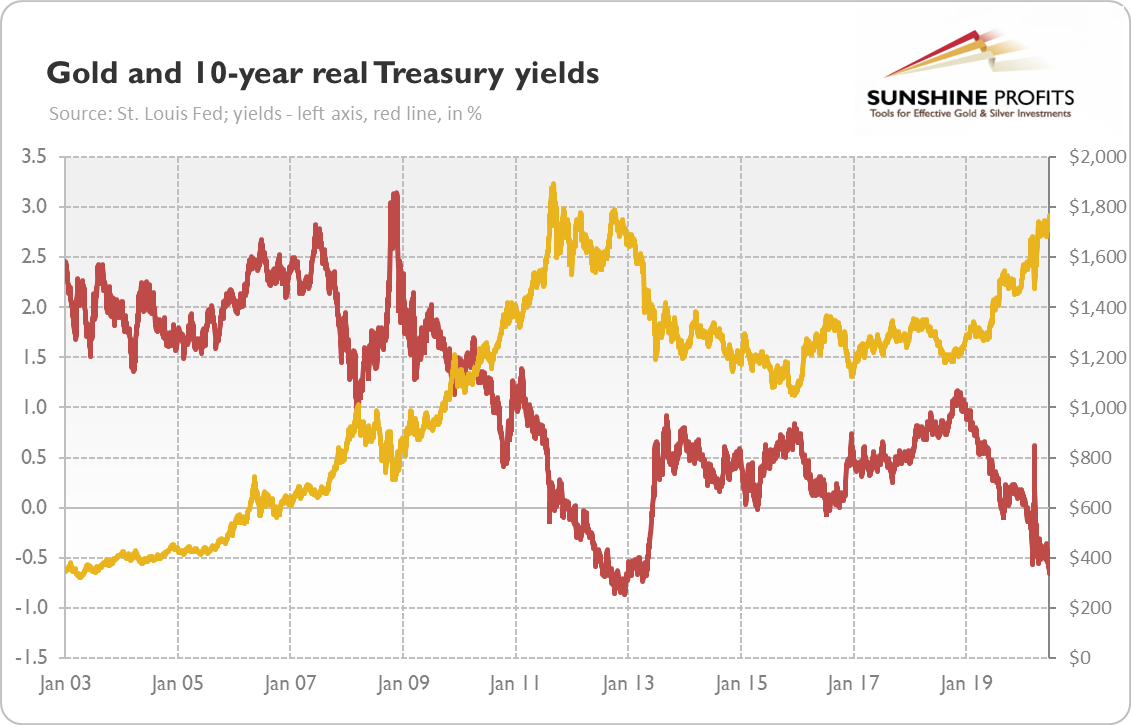

Gold And Bond Yields Link Explained Sunshine Profits

Understanding Bond Prices And Yields

Yield Curve Definition Slope Types Upward Flat Inverted

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)