What Is The Meaning Of Bond Of Indemnity

Recompense for loss damage or injuries. 23082020 What is an indemnity bond.

What Is The Importance Of A Contractor Indemnity Bond By Christina Fox Medium

Indemnity Bond means an under- taking conditioned that the asserted owner of an instrument as principal will protect the issuer and the.

What is the meaning of bond of indemnity. Indemnity is not limited to cases of contract. Specifically a letter of indemnity mandates that if one party is unable to complete the contract that party will pay reparation to the other. This bond is an agreement that protects the lender from loss if the borrower defaults on a legally binding loan.

It helps you get the desired compensation for losses incurred by you against the breach of contract by the other party. Indemnity is a contractual agreement between two parties. Is this valid and can X claim from Y if some third party disputes the title of the property in a court of law.

In the insurance arena many times this is where the story would end as they factor. The bond of indemnity definition is an obligation in writing in which a party has agreed to reimburse the holder of the bond for an injury or loss due to a specific event or has agreed to protect a party from injury or loss related to a specific event. Such letters are traditionally drafted by third-party institutions like.

An indemnity contract arises when one individual takes on the obligation to. An indemnity bond acts as coverage for loss of an obligee when a principal fails to perform according to the standards agreed upon between the obligee and the principal. 24092019 A letter of indemnity LOI is a contractual document that guarantees certain provisions will be met between two parties.

Indemnity bonds are a major subset of surety bonds. Indemnity bond for property title. Greetings You should understand the importance of an indemnity bond and why its required.

A legal agreement in which a financial organization promises to make a payment to an organization. A right of indemnity may arise between a principal and agent an employer and employee and so on. An indemnity bond is a bond that is intended to provide financial reimbursement to the holder for any actual or claimed loss caused by the issuers conduct or another persons conduct.

An indemnity bond is a type of surety bond which as in all surety bonds involves three main parties the principal the obligee and a surety company. A clause in a contract stating that payments must be made regardless of what happens. The indemnity agreement is a separate contract which transfers risk from the surety to the principal.

14112019 Meaning of Indemnity Bond. An indemnitor also called a guarantor is a person or group of people agreeing to cosign for the bail bond of a defendant through a company that offers bail bonds such as an underwriter or agent. 11072018 In simple words an Indemnity Bond is an undertaking provided by a party entering into a contract promising to bear the losses in event of the breach of contract.

If the Obligee or other party to the bond suffers loss or damage they can make a claim on the bond. 26012021 In English Law indemnity is the promise to save a person from the consequences of an act the promise may be expressed or implied. An indemnity bond assures the holder of the bond that they will be duly compensated in case of a possible loss.

An indemnity bond is a bond whose purpose is to reimburse its holder for claimed or actual loss caused by the issuers conduct or another persons actions. X asks for an INDEMNITY BOND from Y to indemnify for any claims rleated to the title of the property. An indemnity bond is a bond that is intended to reimburse the holder for any actual or claimed loss caused by the issuers conduct or another persons conduct.

If the claim is validated the surety company will pay out. Indemnity insurance Hell or high water contract. Bond of indemnity definition is - an indemnification agreement filed with a carrier relieving it from liability for something that it would otherwise be liable for.

An indemnity bond is a bond created. In this arrangement one party agrees to pay for potential losses or damages caused by another party. The process of cosigning on a bond is referred to as indemnification.

Thus when a party liable to perform the obligations as per the contract refuses to oblige the defaulting party has the right to recover the damages and losses incurred by the defaulting party. Indemnity Bond means a written undertaking of a financial institution on behalf of a Customer to cover any losses suffered by EEA arising from non - payment by the Customer of money the Customer owes to EEA. X has purchased a property from Y.

Indemnity Bond Filled Sample Fill Online Printable Fillable Blank Pdffiller

Penal Employment Indemnity Bond Antithesis To Freedom Of Parties

What Is Indemnity Bond Format Wisdom Jobs India

What Is An Indemnity Bond Surety Bond Professionals

What Is An Indemnity Bond Bond Glossary Nouns

Who Should Be The Witness And Surety In The Indemnity Bond Of Tech Mahindra Quora

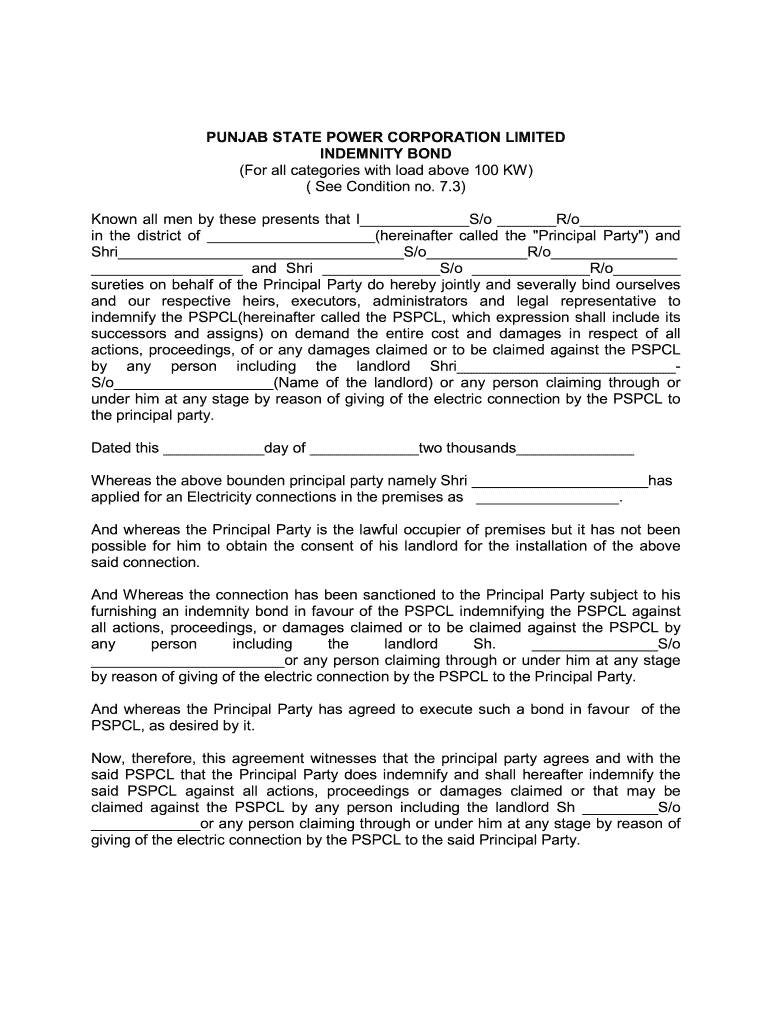

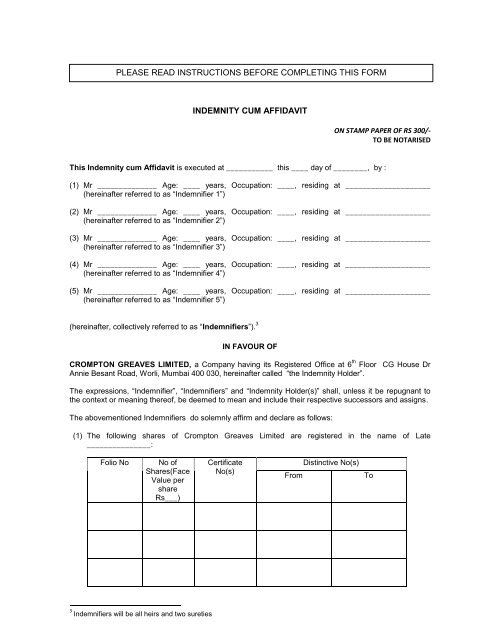

Pdf Indemnity Bond Form Sample Uddin Chowdhury Academia Edu

A Format Of The Indemnity Bond Cum Affidavit Cgglobal Com