What Is Meaning Of Junk Bond

Sometimes larger companies issue them to fund leveraged buyouts. Junk bonds or high yield bonds are issued by a company that is considered to be a higher credit risk.

Junk Bond Spreads Bbb Bond Spreads Blow Out Past Lehman Bankruptcy Levels Wolf Street

30062021 Junk bonds are a type of corporate bond.

What is meaning of junk bond. Junk bonds are bonds that carry a higher risk of default than most bonds issued by corporations and governments. Junk bonds are below-investment-grade corporate bonds with a higher risk and generally a higher yield than other corporate bonds. As regulators seek to curtail borrowing in the debt-laden property market some investors worry that large defaults could pose a systemic risk to the economy.

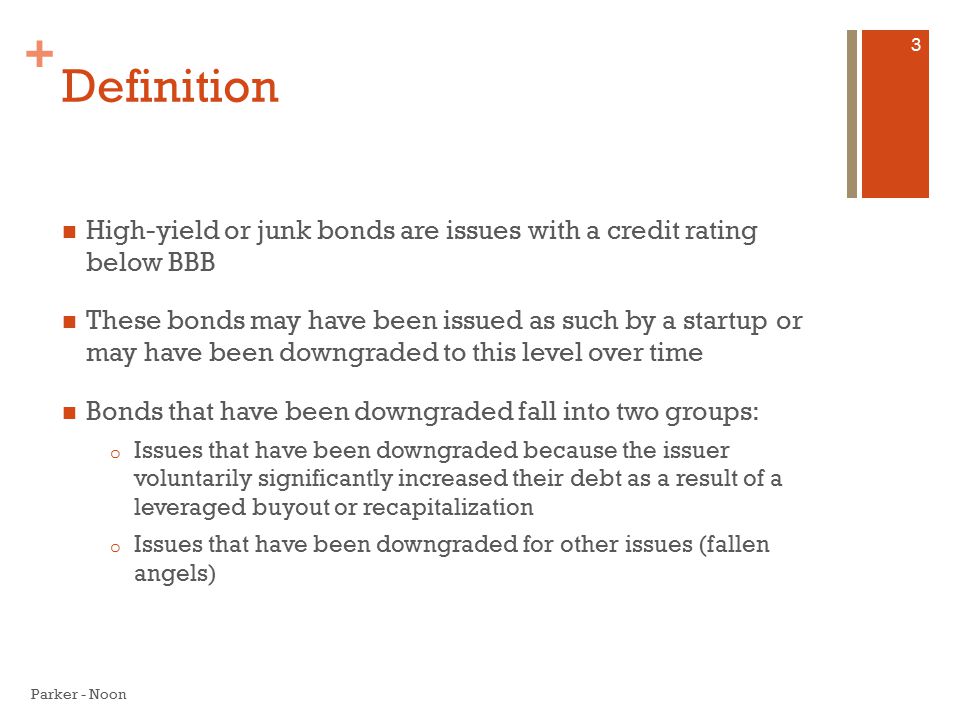

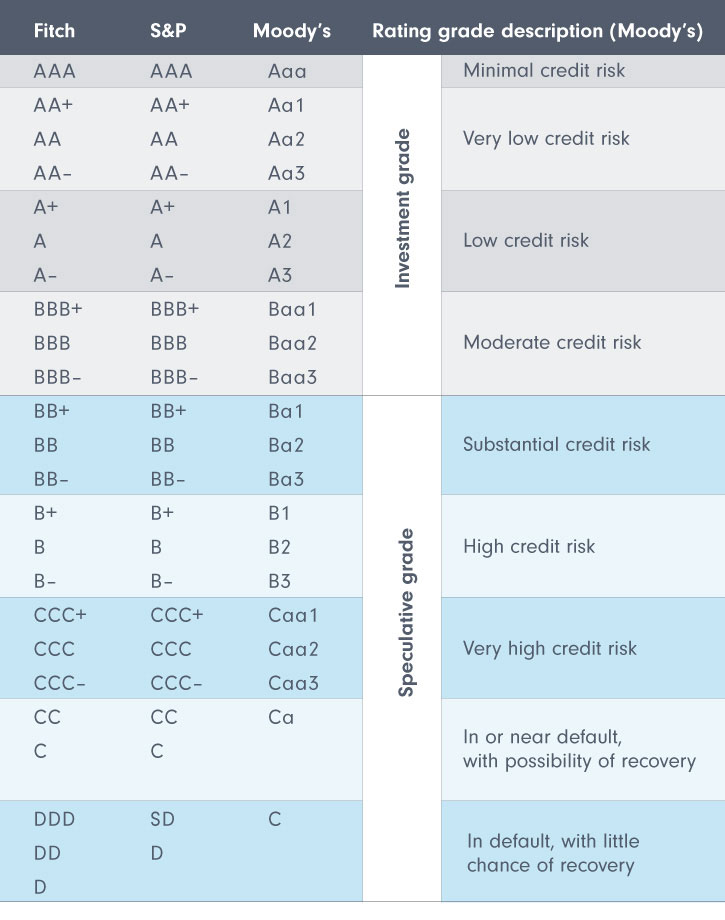

22112019 Bonds that are rated below investment grade are known as junk bonds or high yield bonds. Like any bond a junk bond is an investment in debt. They tend to be more volatile and higher yielding than bonds with superior.

03122019 Junk status what it means and what investors should know. An investor purchases a bond from a bond issuer with the assumption that the money will be paid back when the bond reaches its maturity date. A downgrade will have repercussions for all South Africans.

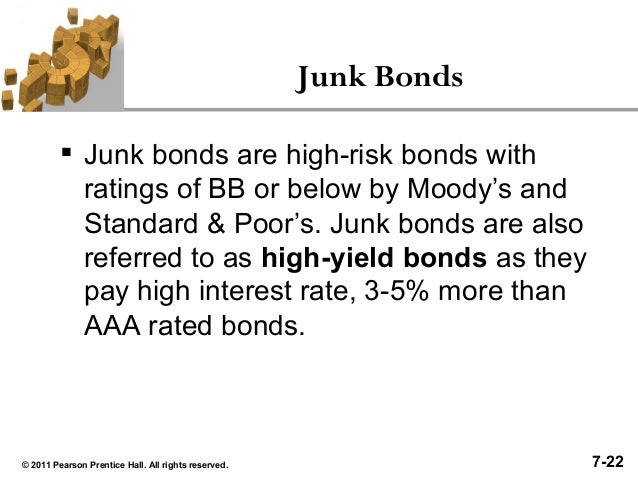

Are generally issued by corporations of questionable financial strength or without proven track records. Heres what you need to know about junk bonds. 04112020 A junk bond is a fixed-income security that is rated below investment grade by one or more of the major bond ratings agencies.

Junk bonds are high-yield bonds that expert investors say are below investment grade. How a Junk Bond Works A junk bond works the same as most other bonds. 15072021 Chinese junk-rated dollar bonds have seen their worst sell-off since the depths of the March 2020 pandemic.

13052020 A non-investment grade speculative is called junk status in investment shorthand. Both bonds also have a maturity date a principal amount that will be paid at maturity and a coupon payment. A bond is a debt or promise to pay investors interest payments along with the return.

The risks associated with investment-grade bonds or investment-grade corporate debt are considered significantly higher than those associated with first-class government bonds. Keep in mind a ratings agency usually waits 18 months before changing an investment status to give the relevant stakeholders time to address their concerns and amend policies. 03052017 What Are Junk Bonds.

Junk bond investors can diversify risk by buying lots of different bonds and sticking to those that are just below investment grade. A junk bond like all bonds is a type of debt security. Moodys has given the country a.

They are also called low-grade bonds and informally junk bonds. Junk bond or mezzanine debt colloquial terms used to describe high-interest high-risk LOAN STOCK which is issued by a company as a means of borrowing money to finance a TAKEOVER BID MANAGEMENT BUY-OUT or MANAGEMENT BUY-IN. Below investment grade means they have a rating of BB or lower.

That said most of the damage to date is limited to specific areas of the market. They have higher yields because they have a higher risk of default on the part of the issuerHigh-yield bonds are considered sufficiently high-risk that the law does not allow banks to invest in them. The party buying the bond is essentially loaning money to the party.

16122014 What are Junk Bonds. In South Africa the main stakeholder would be the SA Reserve Bank. A company or a government raises a sum of money by issuing IOUs stating the amount it is.

On the one hand they offer attractive yields but they also come with significant risk. While you may think of junk as that pile of old stuff in the basement that youve been meaning to throw out the term means something very different for bonds. Below are the differences between a normal bond a junk bond.

The credit rating of a high yield bond is considered speculative grade or below investment grade This means that the chance of default with junk bonds is higher than for other types of bonds. Junk bonds are very similar to traditional normal bonds known as investment-grade bonds also being a loan given to a corporation. 30092020 What is a junk bond.

A bond with a low ratingBonds rated less than Baa3 by Moodys or BBB- by SP or Fitch are considered high-yield bonds. Bonds that are not rated as investment-grade bonds are known as high yield bonds or more derisively as junk bonds. Less well known or smaller companies issue junk bonds when they need funds for their operations.

Understanding High Yield Bonds Pimco

High Yield Bonds Junk Bonds And Their History Ppt Download

Junk Bond Spreads Bbb Bond Spreads Blow Out Past Lehman Bankruptcy Levels Wolf Street

What Are Junk Bonds Definition And Examples Market Business News

Understanding Investment Grade And High Yield Fidelity Singapore

Market Views Are Us High Yield Bonds Still Appealing Family Offices Asianinvestor

:max_bytes(150000):strip_icc()/dotdash_INV_final_Ba3-BB-_Jan_2021-01-4dd68057e7a241629de924cee6005773.jpg)