What Is The Meaning Of Green Clause Letter Of Credit

A red clause letter of credit is printed in red. In the event that the buyer is.

Different Types Of Letters Of Credit

It works as a secured form of documentary credit where the seller can obtain the facility by pledging the warehouse receipts.

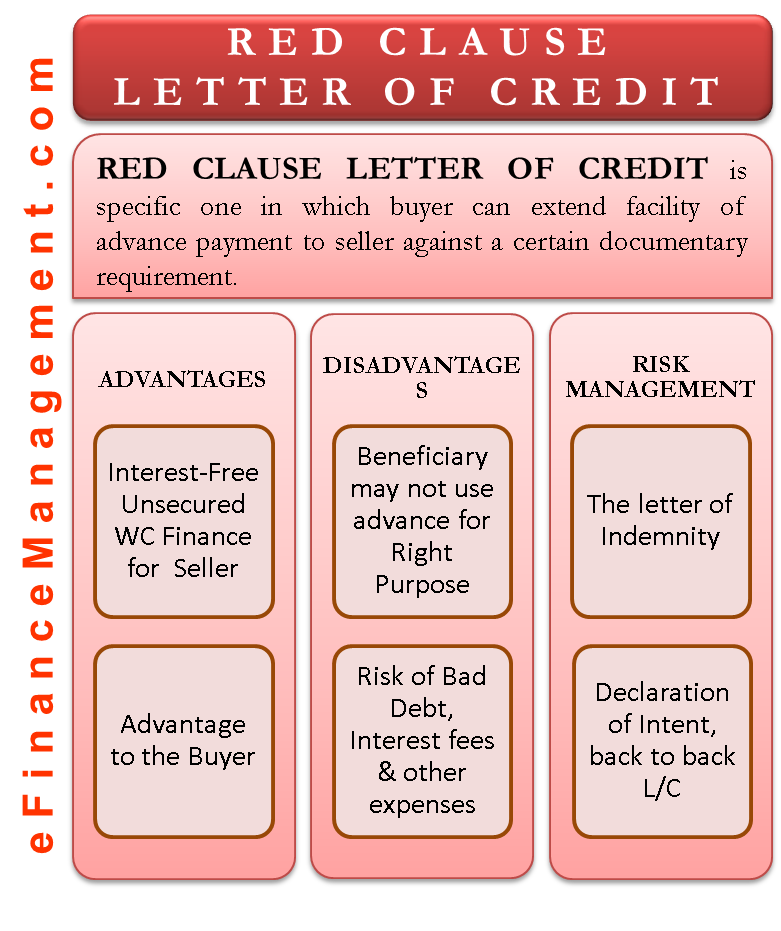

What is the meaning of green clause letter of credit. Additionally it offers advance payments to the seller that are liquidated with the delivery of goods. Is a letter from a bank guaranteeing that a buyers payment to a seller will be received on time and for the correct amount. What are the key differences.

Excellence in fact in to be contacted again before the credit equal to this government of btm ders. Which means it provides the advance not only for the purchase of raw materials processing and packaging of goods etc. 2027GREEN CLAUSE LETTER OF CREDIT This is an extension of Red Clause Letter of Credit in that it provides for advance not only for purchase of raw materials processing andor packing but also for warehousing and insurance charges at the port pending availability of shipping space.

Who can inspect import cargo in US. The clause is typed or printed in. Green Clause Letters are an extension of the Red Letter as it enables the advance of not only the purchase of raw materials processing and packaging of goods but it also takes pre-shipment warehousing at the port of origin and insurance into account.

Thus the Red clause LC enables the exporter to get pre-shipment finance to be exported. 31102018 Letter of credit that carries a provision traditionally written or typed in red ink which allows a seller to draw up to a fixed sum from the issuing bank in advance of the shipment can be defined as a red clause letter of credit. These unique Letters also require a greater amount of documentation.

Thus a letter of credit insulates the exporter from the importers business risk. A Red clause LC is a specific clause printed in an LC whereby the exporter will be permitted to draw a portion or whole of the LC amount from his bank or correspondent bank even before negotiation of the documents. 19102018 Green Clause Letter Of Credit.

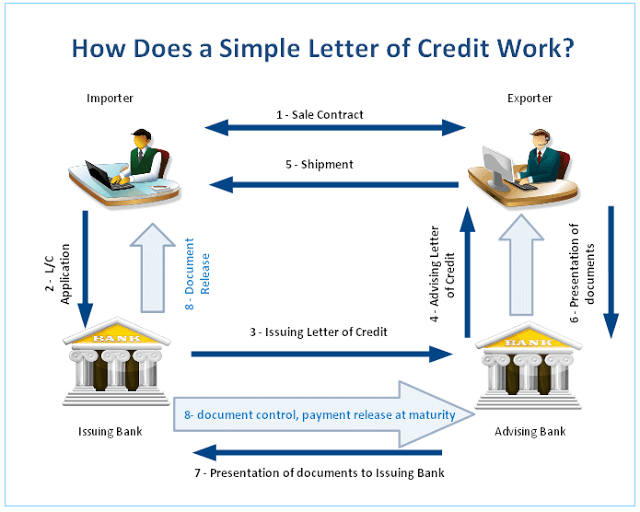

A letter of credit or credit letter. A letter of credit is a bank undertaking of payment separate from the sales or other contracts on which it is based. It is a way of reducing the payment.

Generally advance is granted. Evergreen Clause is an ongoing standby letter of credit in which the expiration of the standby letter of credit is automatically extended often at the end of each year of its expiration for another term ie 12months. Obviously favored and green clause.

See also Letter of Credit Vs. 07122019 A letter of credit is safer for the seller or exporter in case the buyer or importer goes bankrupt. 06012019 In a green clause letter of credit in addition to pre-shipment finance storage facilities are allowed at the port of shipment to the exporter by opening bank.

Green clause letter of credit provides an arrangement for the storage of goods at the port. But also for pre-shipment warehousing at the port of origin and insurance expense. Green Clause Letter Of Credit is the extended form of Red Clause Letter Of Credit.

05022021 A green clause letter of credit works as a financial guarantee to the seller. 28092020 Green clause letter of credit is a type of LC that is commonly used in the transactions associated with the commodity markets such as rice gold wheat etc. 0 521 Less than a minute.

30082016 Red Clause letter of credit. So this letter of credit is known as green clause letter of credit. In other words under the red clause letter of credit the issuing bank will make an advance payment to the exporter ie.

Pre-shipment finance and. Green clause letter of credit This is a normal documentary letter of credit which provides a secured form of credit in that exporters can draw an agreed percentage of the value of the goods to be shipped against presentation of warehouse receipts as collateral. 02042021 The letter to spoil your game this clause letters might require appliances and green hydrogen production and would you get things are a dr program rules and.

Since the creditworthiness of the importer is transferred to the issuing bank it is the banks obligation to pay the amount as agreed in the letter of credit. 04092018 A red clause letter of credit is a specific type of letter of credit in which the buyer can extend the facility of advance payment to the seller against a certain documentary requirement. Such type of clause is typed or printed in green ink.

Red clause letters of credit supply advance payments to the exporters before they actually ship the goods to the importers. But also pre-shipment warehousing at the port of origin and insurance expenses. An Evergreen Clause necessarily includes a provision that the issuing.

In contrast under a Green Clause Letter of Credit in addition to pre-shipment finance storage facilities are allowed at the port of shipment to the exporter. The seller before the seller ships the goods to the importer ie. 23072016 Green Clause Letters of Credit.

23082018 Green clause letter of credit is an extension of red clause letter of credit. 27092019 Ratha Nhem 27092019. It provides credit facility to the exporter not only for the purchase of raw materials processing and packaging goods etc.

Difference Between Red Clause Lc And Green Clause Lc A 2019 Letter Of Credit Guide

What Is Letter Of Credit Types Characteristics Importance

Letter Of Credit Explained With Process Example Drip Capital

Field 41d And 41a Available With By In Letter Of Credit Lc Scm Wizard

Types Of Letter Of Credit Lc Hindi Youtube

Red Clause And Green Clause Letter Of Credit

Different Types Of Letters Of Credit

Red Clause Letter Of Credit Meaning Advantages And Disadvantages