What Is The Meaning Of Account Sweep

Feature or sweep account. In a sweep account.

Cash Sweeping Account What Is It And Should You Use It

A bank account that automatically transfers money into another account or investment that pays.

What is the meaning of account sweep. Sweep accounts allow small businesses to get higher returns on cash that. 03102019 Every brokerage account has what is called a sweep. This is called the sweep.

It automatically keeps the checking account balance at a preset target level by transferring funds to or from the investment account as needed. What does SWEEP ACCOUNT mean. This benefits the account holder by allowing.

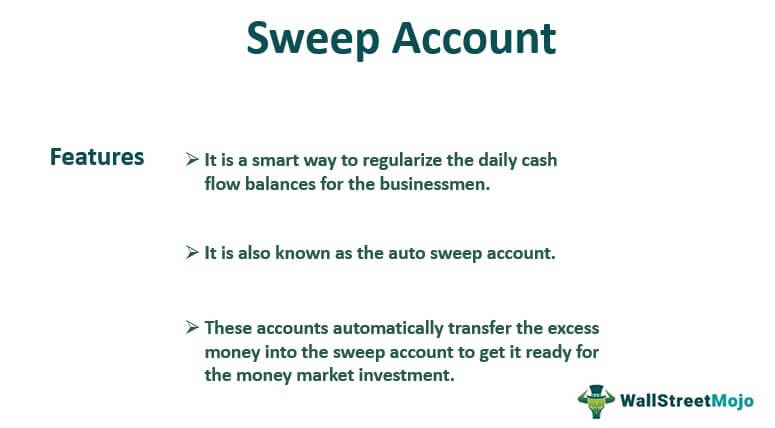

01062021 A regular sweep account is a type of account where money automatically sweeps into the account when it is not in use rather than letting it sit in cash. A sweep account is a bank or brokerage account that automatically transfers amounts that exceed or fall short of a certain. A sweep account links a commercial checking account with an investment account such as a money market account or stock fund.

This is an innovative deposit option that allows you the convenience of a bank account without compromising on the interest that your money earns compared with a long-term. Sweep Account Definition A sweep account is a combination of two or more accounts at a bank or financial institution. Basically sweep means transfer from one account to another account.

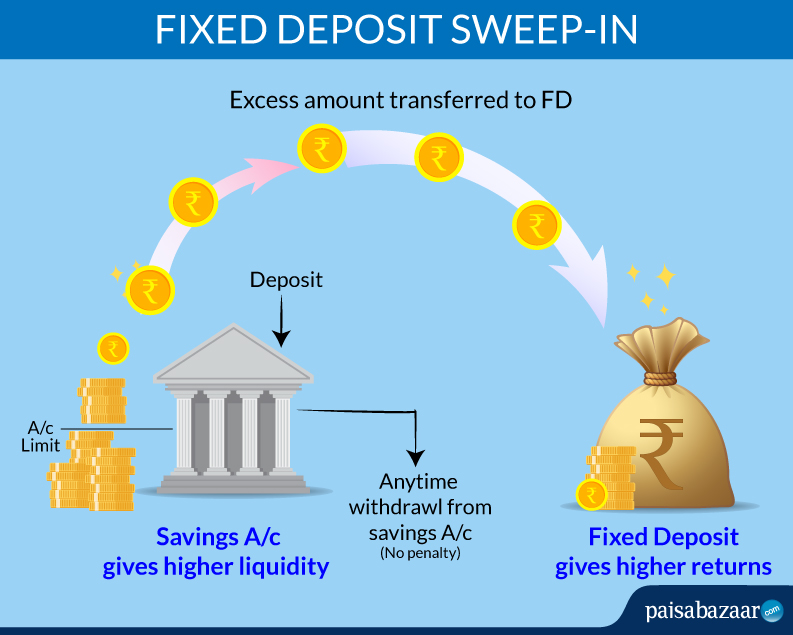

If your saving account is having balance say more than 10000 then excess amount over and above rs1000 will move to fixed deposit account which is giving interest more than saving bank interest. 01052021 A cash sweeping system also known as physical pooling is designed to move the cash in a companys outlying bank accounts into a central concentration account from which it can be more easily invested. ZBA is sometimes called physical pooling to distinguish it from notional pooling.

When you setup a new brokerage account you usually have to assign what you do with your cash. 28042020 A credit sweep is an arrangement between a bank and customer whereby any excess funds in an account can be used to pay down the customers debt. To clean something especially a floor by using a brush to collect the dirt into one place from.

What Is a Sweep Account. Many private and some nationalised bank giving service which is like this. If playback doesnt begin shortly try restarting your device.

For instance at the end of each business day a bank might sweep a business clients surplus cash from a checking account into a high-yield money market or savings account where the money earns. Here the account holder decides the minimum amount to be kept in. By concentrating cash in one place a business can place funds in larger financial instruments at higher rates of return.

It is useful in managing a steady cash flow between a cash account used to make scheduled payments and an investment account where the cash is able to accrue a higher return. Unlocking opportunities in Metal and Mining Many Banks have introduced a savings cum fixed deposit product called a Sweep Account. This type of arrangement is set up automatically and.

Sweep accounts are useful in managing a steady cash flow between a cash account used to make scheduled payments and an investment account where the cash is able to accrue a higher return. Zero balance accounts ZBA also known as sweeping is an arrangement whereby banks transfer sweep funds from a number of operating accounts to a designated header or master account at the close of business every day. It can be both a benefit or a detriment depending on how you use it and what options you selected when you set it up.

27082020 Put in its simplest terms and as worded by an Etrade representative a sweep account can be viewed as a holding account for cash that is earmarked to go elsewhere but hasnt gone there yet or for cash that may be laying around in your account. A sweep account is a kind of bank or brokerage account in which if the account balance of the customer gets above the average limit set by the customers then the excess amount get transferred to high interest bearing money market account. A sweep account combines two or more accounts at a bank or a financial institution moving funds between them in a predetermined manner.

A brokerage firm or bank may automatically transfer -- or sweep -- a clients uninvested or surplus funds into a designated account. SWEEP ACCOUNT meaning. 18092008 What is a sweep account.

What You Need To Know About Sweep Accounts Allbusiness Com

Cash Sweeping Account What Is It And Should You Use It

What Is Monthly Average Balance Or Mab Of Savings Account Basunivesh

Sweeping Zero Balance Account Zba Treasury Prism

Sweep Definicion Y Significado Diccionario Ingles Collins

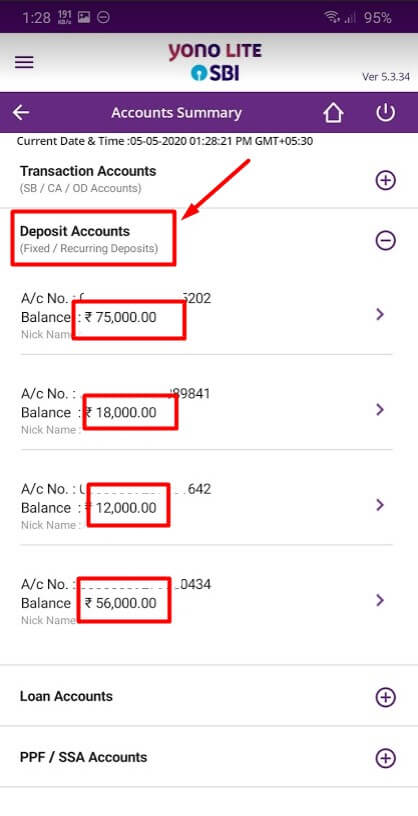

Stop Auto Sweep In Sbi State Bank Of India Banking

What Is Auto Sweep Bank Account

Sweep Account Meaning Example Features Advantages

Fixed Deposit Sweep In Hdfc Yes Bank Sbi Icici Bank Paisabazaar Com