What Is The Meaning Of Plain Vanilla Bond

Plain vanilla bonds are easier to trade and they have tighter spreads. It is one of the simplest forms of bond with a fixed coupon and a defined maturity and is usually issued and redeemed at the face value.

/dotdash_Final_How_to_Value_Interest_Rate_Swaps_Sep_2020-01-4b6f55263e5a41b091bded09d63da811.jpg)

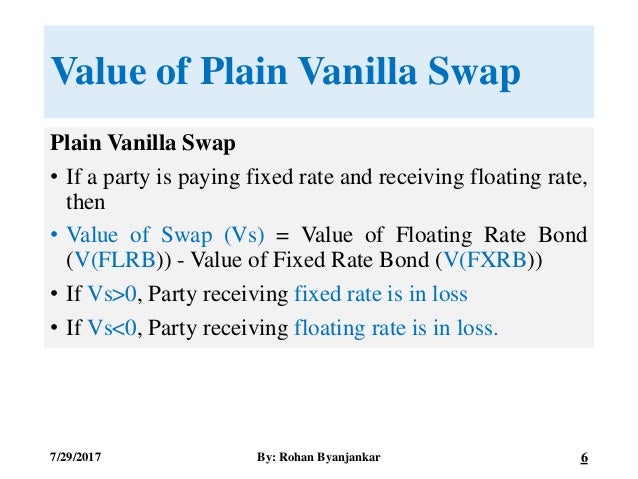

How To Value Interest Rate Swaps

For example the value of a callable bond for the bondholder equals the value of the underlying plain-vanilla bond minus the.

What is the meaning of plain vanilla bond. Has been added to list. A plain vanilla bond comes with predefined features such as maturity date coupon rate issue price and face value. PLAIN VANILLA BOND meaning in the Cambridge English Dictionary.

Likewise a plain-vanilla bond is not convertible and cannot be called. A Plain Vanilla Bond is also known as a straight bond or a bullet bond. There are always buyers and sellers in plain vanilla bonds.

Essentially plain vanilla is the opposite of an exotic financial instrument which takes a traditional financial instrument and alters the components of it to create a more complex. It is the opposite of an exotic. Related to Plain vanilla.

25012019 A plain vanilla bond is the most basic type of bond wherein when an investor buys a bond there is a fixed coupon payment at pre-determined fixed intervals and the maturity of the bond is also pre-determined. Plain vanilla is the most basic or standard version of a financial instrument usually options bonds futures and swaps. It is one of the simplest forms of bond with a fixed coupon and a defined maturity and is usually issued and redeemed at the face value.

For example a plain-vanilla derivative is typically exchange-traded and void of bells and whistles. 12082016 A Plain Vanilla Bond is a bond without any unusual features. Vanilla bond just means it doesnt have any special features like a call provision.

Plain vanilla bonds are basically the benchmark bonds with large issues where the transaction can be done with a very tight spread. 24072020 A straight bond is a plain vanilla bond that obliges the issuer to regular fixed interest as well as principal repayment upon maturity. Price Plain Vanilla Bond the price of a plain-vanilla bond that shares similar features with a putable bond.

Duration is indication of a bonds sensitivity to a change in interest rates. Of or relating to the uncomplicated version of a particular type of security. Over the life of a bond these values do not change as.

Price Put Option the price of a put option to redeem the bond prior to maturity. They are tight and easy to trade. 13052021 The term plain vanilla refers to the simplicity of the financial instrument.

03042015 A plain vanilla bond is a bond without any unusual features. In analogy with the common ice cream flavour vanilla which became widely and cheaply available. Carries a credit rating of AA and above of unsupported bank borrowings or plain vanilla bonds highest rating to be considered in case of multiple ratings.

Also known as a bullet bond these issues do not have any. From Wikipedia the free encyclopedia Plain vanilla is an adjective describing the simplest version of something without any optional extras basic or ordinary. It is one of the simplest forms of bond with a fixed coupon and a defined maturity and is usually issued and redeemed at the face value.

Furthermore the face value of the bond is also predetermined and the issuer redeems the bond at face value on the date of maturity. It is also known as a straight bond or a bullet bond. 05122018 Having long term maturity of more than 1 year outstanding borrowings excluding ECBs and borrowings between parent and subsidiary of Rs.

Plain Vanilla Bonds A plain vanilla bond is a bond without any unusual features. Plain Vanilla is the simplest or most basic standard version of a financial instrument in the form of options futures swaps and bonds. Essentially the valuation of securities with an embedded option is a combination of the valuation of plain-vanilla bond or stock and options valuation.

100 cr and above. Plain vanilla swap Plain vanilla A term that refers to a relatively simple derivative financial instrument usually a swap or other derivative that is. It is also known as a straight bond or a bullet bond.

The article above is best summary.

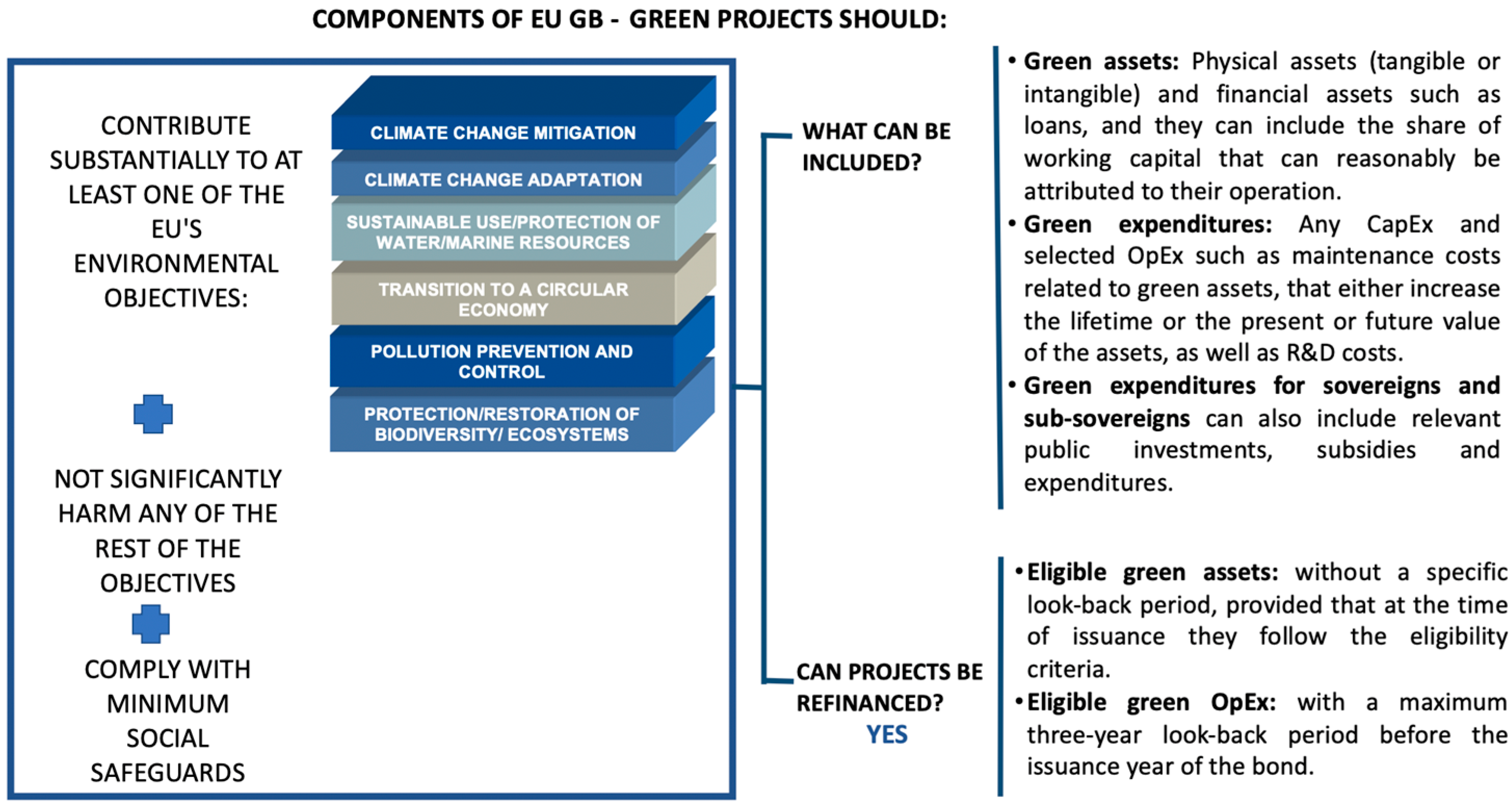

Sustainability Free Full Text On The Effect Of Green Bonds On The Profitability And Credit Quality Of Project Financing Html

What Is Plain Vanilla Bond Qs Study

Understanding Interest Rate Swap Price Of Interest Rate Swap And Val

Article Types Of Bonds Types Of Bonds India Dictionary

Http Pubdocs Worldbank Org En 554231525378003380 Publicationpensionfundservicegreenbonds201712 Rev Pdf

/AgencyBonds_LimitedRiskAndHigherReturn32-9a575588ab6b4e4484cc80d0a8f9710c.png)

Agency Bonds Limited Risk And Higher Return

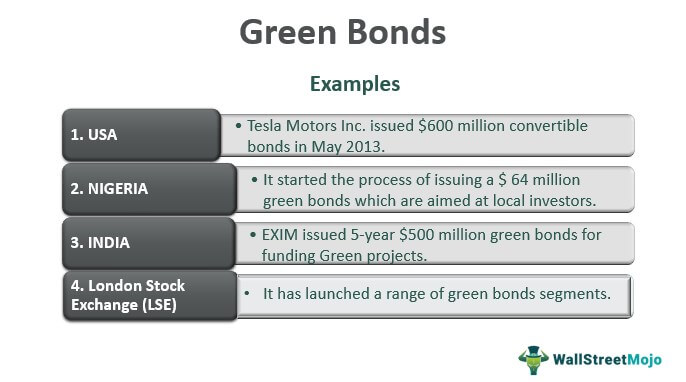

Green Bond Definition Examples Origin Demand Of Green Bonds

Bond Valuation And Bond Yields P4 Advanced Financial Management Acca Qualification Students Acca Global

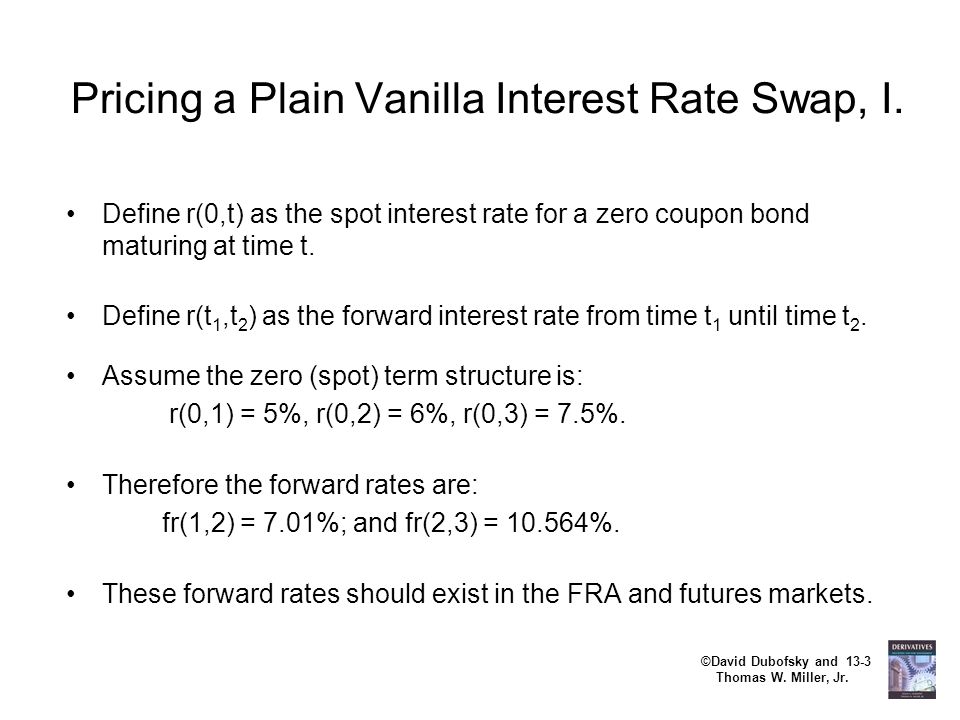

Chapter 13 Pricing And Valuing Swaps Ppt Download