What Is The Definition Junk Bond

A bond that has a high risk that it will not be paid back but that may possibly make a large. Junk bond is the popular name for high-risk bonds offered by corporations.

What S So Junk About Junk Bonds Colorado Financial Management

Junk bonds represent bonds issued by companies that are struggling financially and have a high risk of defaulting or not paying their interest payments or repaying the principal to investors.

What is the definition junk bond. Note that a relationship is a debt where investors receive the interest payment including the return of the principal they have invested in exchange for a bond purchase. Less well known or smaller companies issue junk bonds when they need funds for their operations. In the case of corporate bonds junk bond investors will often leverage the fact that bondholders are paid out before shareholders.

A bond is a debt or promises to pay investors interest payments and the return of invested principal in exchange for buying the bond. Below are the differences between a normal bond a junk bond. How a Junk Bond Works A junk bond works the same as most other bonds.

So if a company is liquidated bondholders will have the first claim on the assets. 19122020 Junk Bond Definition Junk bond refers to bonds that have the highest risk of default than those bonds that the governments and corporation issues. An investor purchases a bond from a bond issuer with the assumption that the money will be paid back when the bond reaches its maturity date.

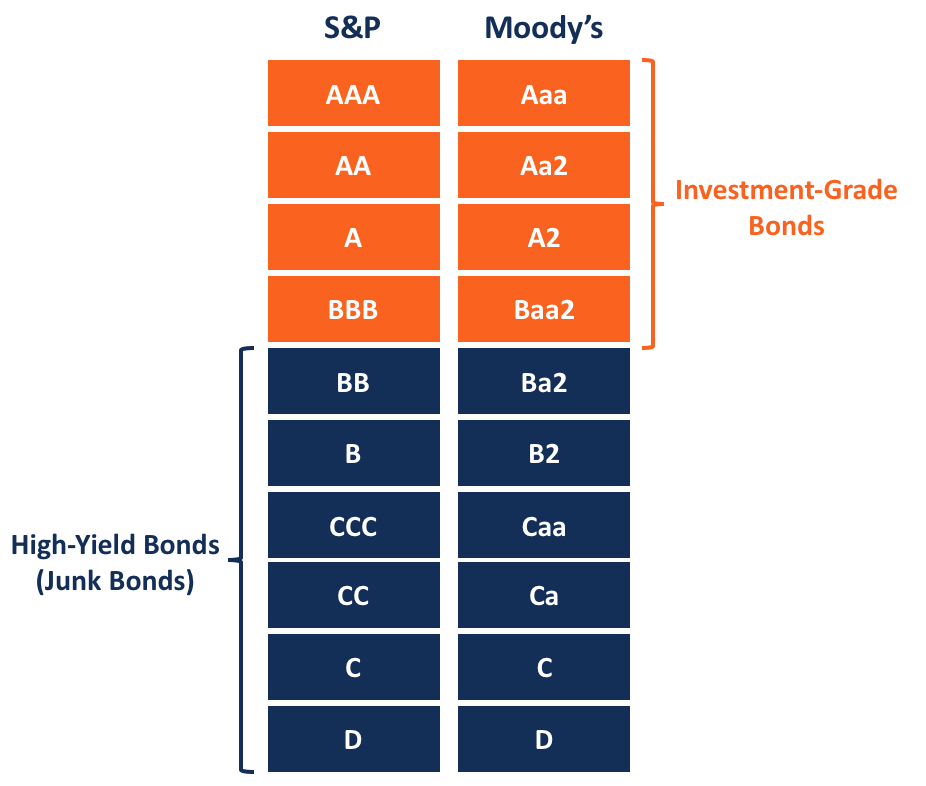

04112020 A junk bond is a fixed-income security that is rated below investment grade by one or more of the major bond ratings agencies. A company or a government raises a sum of money by issuing IOUs stating the amount it is borrowing the principal the date it will return. Default risk is the chance that a company or government will be unable to pay its obligations when the bonds mature.

Junk bonds carry a higher risk of default than other bonds but they pay higher returns to make them attractive to investors. Junk bonds are very similar to traditional normal bonds known as investment-grade bonds also being a loan given to a corporation. A bond is a debt or promise to pay investors interest payments along with the return.

Like any bond a junk bond is an investment in debt. 21062021 Definition of junk bond. The party buying the bond is essentially loaning money to the party.

Defaults on bonds most often occur within the first several years of a bonds. A speculative bond rated BB or below by Standard. Below investment grade means they have a rating of BB or lower.

Junk bonds are bonds that carry a higher risk of default than most bonds issued by corporations and governments. Sometimes larger companies issue them to fund leveraged buyouts. A bond is a certificate or some other evidence of a debt.

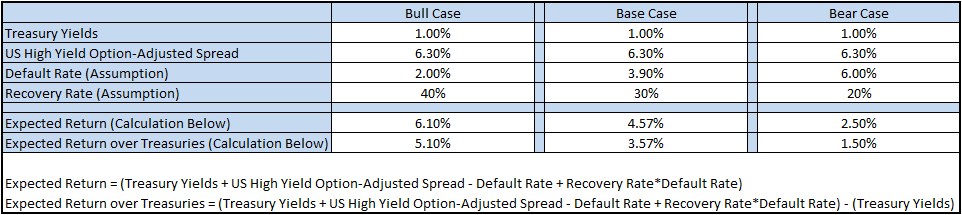

Junk bonds are high-yield bonds that expert investors say are below investment grade. Junk bonds also known as high-yield bonds are bonds that are rated below investment grade by the big three rating agencies see image below. A high-risk bond that offers a high yield.

03052017 What Are Junk Bonds. 30092020 What is a junk bond. 30062021 Junk bonds are a type of corporate bond.

Both bonds also have a maturity date a principal amount that will be paid at maturity and a coupon payment. A junk bond like all bonds is a type of debt security. Are generally issued by.

Junk bonds are below-investment-grade corporate bonds with a higher risk and generally a higher yield than other corporate bonds. 22112019 If a junk bond is upgraded to investment grade investors can make an immediate profit when the price adjusts to the new rating. A security issued by a corporation that is considered to offer a high risk to bondholders.

And Ba or below by Moodys Investor Service. While you may think of junk as that pile of old stuff in the basement that youve been meaning to throw out the term means something very different for bonds. Colloquial terms used to describe high-interest high-risk LOAN STOCK which is issued by a company as a means of borrowing money to finance a TAKEOVER BID MANAGEMENT BUY-OUT or MANAGEMENT BUY-IN.

What Are Junk Bonds Definition And Examples Market Business News

What Are High Yield Junk Bonds Definition Pros Cons Of Investing

What S So Junk About Junk Bonds Colorado Financial Management

/dotdash_Final_Everything_You_Need_to_Know_About_Junk_Bonds_Dec_2020-01-5306bf5871c8424bacc317dd8bef5c90.jpg)

Everything You Need To Know About Junk Bonds

Steer Clear Of Junk Bonds With High Yield

High Yield Bond Overview Credit Rating Real World Examples

Post a Comment for "What Is The Definition Junk Bond"